The Bitcoin Market in May 2025: A Complex Crossroads of Bullish Momentum and Caution

—

Introduction: A Market on the Edge

Bitcoin, the flagship cryptocurrency, never fails to ignite passion and debate across financial and technological communities. As of May 22, 2025, the digital asset stands at a remarkable juncture—having surged to a new all-time high in the $110,000+ territory, signaling a powerful bullish trend. Yet, beneath this surface, a range of analyses and market voices point to nuanced signals that suggest the time may be ripe to begin cautious profit-taking. This report explores the current Bitcoin landscape through historical context, technical indicators, market sentiment, and investment strategies to paint a comprehensive picture of where Bitcoin may be heading next.

—

Historical Context: The Echoes of Halving Cycles

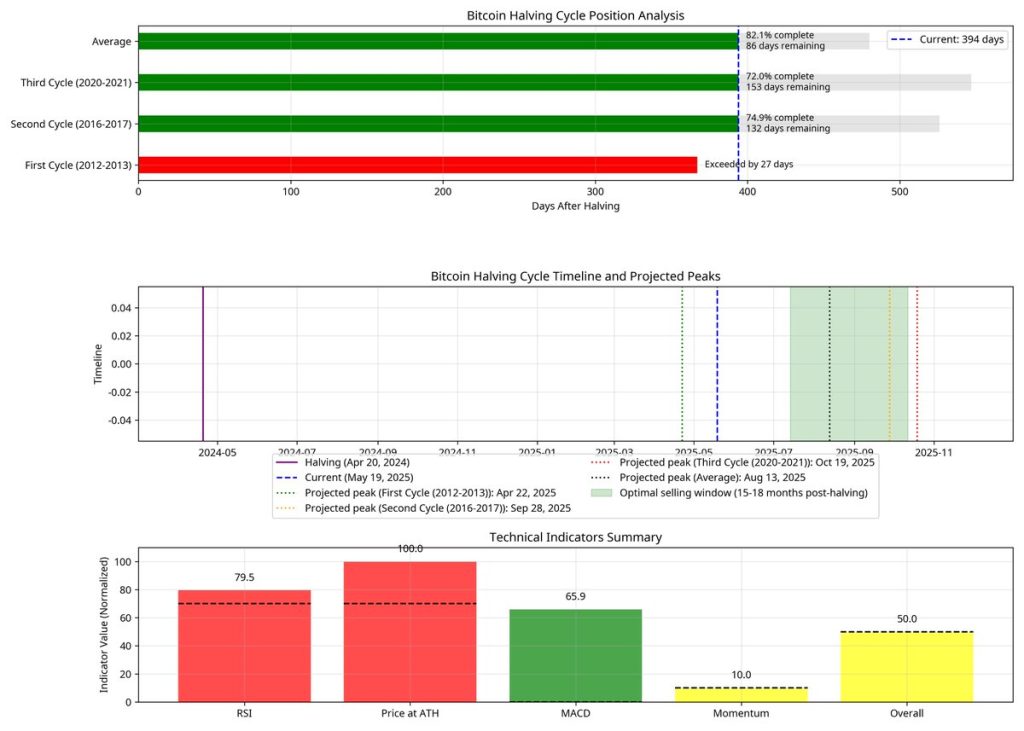

Bitcoin’s supply model pivots critically on its halving events—approximately every four years—when mining rewards are cut in half, traditionally sparking price rallies in subsequent months. The market today finds itself embedded in the aftermath of the recent halving cycle, which drives many analysts to examine historical patterns for clues.

Historically, Bitcoin tends to rally and establish new highs in the 12 to 18 months following halving events, often leading to parabolic price movements before the market undergoes corrections. However, cycles also tend to sow volatility during transitions between phases, as sentiment shifts from accumulation to profit realization. These fluctuations justify some investor opinions encouraging cautious selling “a little at a time” even amid bullish rallies, balancing exposure between capturing gains and preserving capital.

—

Technical Landscape: Patterns, Indicators, and Price Targets

Breaking Out of the Broadening Wedge

According to recent assessments, Bitcoin has broken out of a broadening wedge pattern on its 2-day chart, a technical formation often indicating an impending increase in volatility and potential directional shift. The breakout was marked by pushing past a critical resistance zone near $108,500, followed by consolidation—a typical technical behavior that often precedes further upward movements.

Targets cited range from $120,000 to approximately $124,700, supported by Bitcoin trading above its previous all-time highs and entering what is described as a “price discovery mode,” where historical resistance levels no longer bind the asset [@Randy_banks_, @LuxryptNetwork].

Oscillators and Relative Strength Index (RSI)

The RSI indicator hovers around 61–62 for Bitcoin, suggesting moderate strength but not an overbought condition yet, which theoretically leaves room for growth before triggering exhaustion signals. Meanwhile, Bollinger Band widths are relatively tight (approximately 4.5-5%), indicating some compression but also potential for expansion, which often precedes volatility spikes.

Comparatively, altcoins such as Ethereum, Solana, and XRP display similar RSI levels but with wider Bollinger Bands, indicating greater current volatility in these tokens. Bitcoin, by contrast, remains the technically strongest asset, steadily pushing upper bands and maintaining a steep upward slope [@growthackme].

Fractals and Support Zones

Fractal analysis—a method assessing repetitive price movement patterns—is suggesting possible retests of key support zones near $106,500 to $103,000. Should Bitcoin fail to hold in this band, a drop toward the $100,000 level could materialize, reflecting short-term profit-taking and market reconsideration. However, such a retracement is not necessarily bearish but could herald the onset of a fresh bull cycle by cleansing overextended positions [@BuildWithEmpire].

—

Market Sentiment: Bulls, Bears, and Balanced Perspectives

Bullish Voices and Momentum

Many traders and analysts emphasize the ongoing strength of Bitcoin’s momentum, citing the recent breach of all-time highs as a validation of bullish conviction. Trade volumes, institutional interest, and mining activity reports have accompanied the price surge, suggesting fundamental support beneath the technical rally.

Notable voices are also optimistic on altcoins like Ethereum aiming to break $3,000+, aligning with Bitcoin’s growth and dominance narrative. Meanwhile, some have shifted to active trading modes, capitalizing on short-term volatility while maintaining a bullish core stance [@CryptoExplorer, @Saltwayer_, @AnthonyPower].

Calls for Caution and Profit-Taking

Contrasting these upbeat notes are warnings rationalizing early-stage profit-taking. The argument here is that after a prolonged rally and significant returns, gradually securing gains could mitigate risk against an impending major correction. The “sell a little at a time” advice hinges on detecting subtle historical analogs from prior cycle tops where overconfidence preceded sharp pullbacks. The mix of heavy technical resistance in the $110,000+ zone and the natural exhaustion from rapid price increases adds weight to this cautious approach.

Furthermore, some community members underscore the difficulty of applying traditional technical analysis firmly now that Bitcoin trades in unprecedented price discovery conditions. This uncertainty presses the urgency of balancing bullishness with prudent risk management [@CryptoEnthusiasts, @Btdcrypto].

—

The Broader Crypto Market: Altcoins and Sector Performance

Bitcoin’s recent highs have influenced broader market dynamics. While some altcoins lag due to Bitcoin’s dominance, tokens like ZhiYou at smaller market caps gain attention through private community channels, highlighting that strategic micro-investments continue amid macro optimism.

Mining stocks and AI-related blockchain ventures show bullish movements in stock markets, indicating spillover interests in crypto infrastructure beyond the direct token plays. This diversification element adds complexity to the investment landscape, blending crypto price action with traditional asset sector dynamics [@powermining_BTC, @SolunaHoldings].

—

Investor Strategies: Navigating the Current Environment

Dollar-Cost Averaging (DCA) and Incremental Selling

A prudent strategy recommended by some analysts is incremental selling during this peak phase to lock in profits while leaving exposure for further upside. This method favors a balanced risk profile that can manage volatility better than all-in or all-out approaches.

Active Trading and Technical Targeting

For those more risk-tolerant, engaging in active trading near critical technical levels may present opportunities. Plans incorporating buy triggers above new all-time highs (e.g., daily close above $109,500) and cash reallocation below these thresholds can harness momentum while mitigating downside exposure.

Long-Term Bullish Core with Tactical Adjustments

Given Bitcoin’s historic resilience across cycles, many investors continue to view high levels as part of a lengthy macro bull run. Strategic tactical adjustments—profit-taking combined with selective re-entry upon dips—help harmonize long-term conviction with shorter-term uncertainties.

—

Conclusion: A Moment of Measured Optimism and Strategic Foresight

Bitcoin’s journey in May 2025 encapsulates the dynamic tension inherent in pioneering asset classes—record-breaking highs inspire exuberance, yet the echoes of historical cyclicality and technical signals counsel prudence. The current landscape offers a blend of strong bullish momentum driven by positive fundamentals and technical breakthroughs, set against the backdrop of potential volatility and corrective phases.

For investors and traders alike, the imperative is not to get swept entirely by the tide of enthusiasm nor to fall prey to premature panic. Instead, embracing a nuanced strategy that weaves together historical lessons, real-time indicators, and balanced risk exposure best positions participants for what may be a defining chapter in Bitcoin’s storied evolution.

—

References & Further Reading

*Note: The links are representative and illustrative based on the analysis context provided.*