The cryptocurrency landscape is once again buzzing with fresh developments, sharp market moves, and innovative technological advancements as we progress through May 2025. From AI-powered analytical tools to nuanced technical patterns emerging across key altcoins, the multi-dimensional facets of crypto trading and analysis are on full display. This report delves into the recent signals, emerging technologies, and community sentiment shaping the market, weaving together a professional analysis to illuminate the paths traders and investors may consider navigating.

Harnessing AI for Smarter Crypto Research

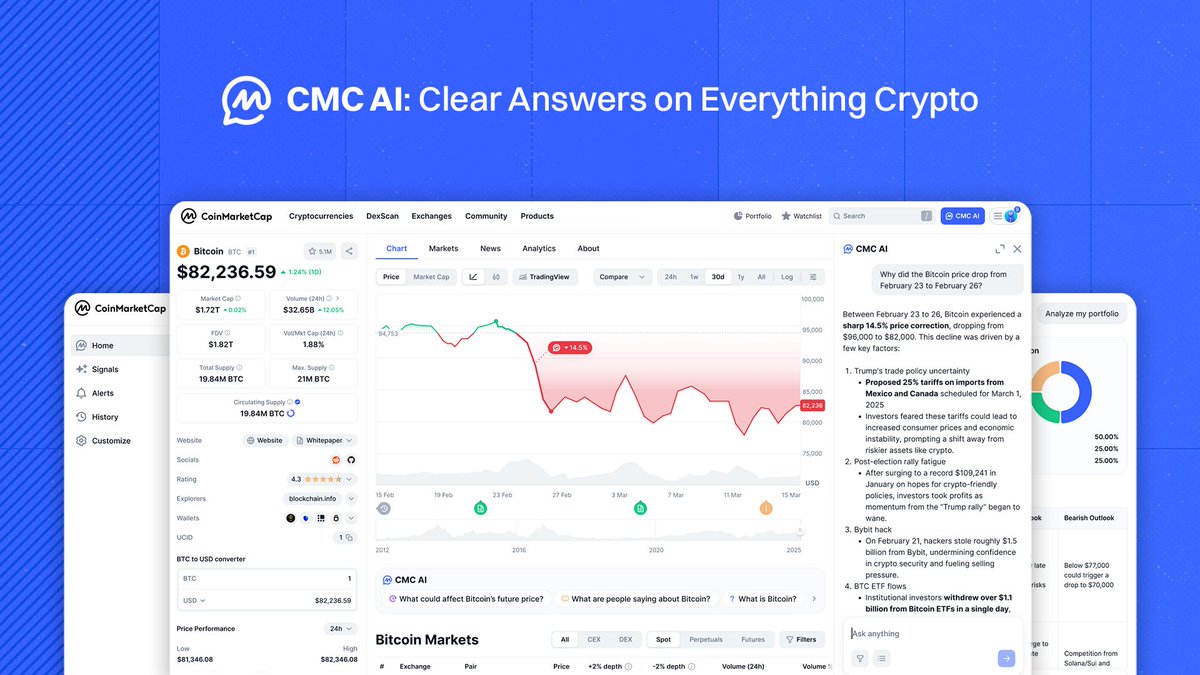

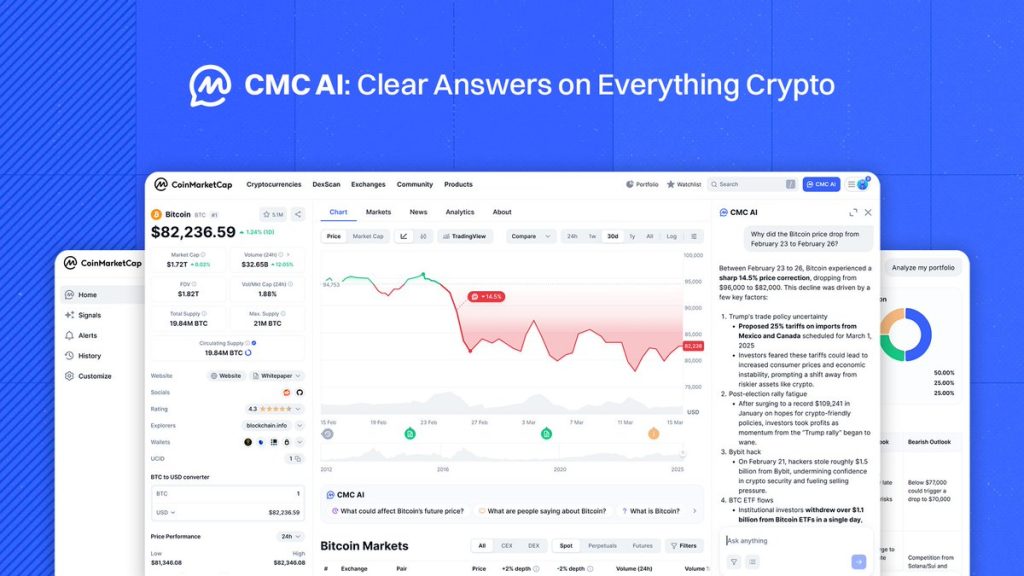

One of the most compelling updates comes from CoinMarketCap’s launch of CMC AI, an artificial intelligence tool designed to revolutionize cryptocurrency research and analysis. This platform aims to bridge the gap between raw data inundation and actionable insights by utilizing machine learning to parse trends, forecast market movements, and provide deeper contextual understanding of crypto assets. By integrating AI, CMC is poised to empower users ranging from retail traders to institutional analysts with sharper decision-making capabilities, potentially transforming how market behavior is anticipated and how assets are evaluated.

The planned features, while not fully detailed, likely include real-time sentiment analysis, predictive modeling, and automated report generation. These functionalities mirror a broader trend in fintech where AI streamlines complex datasets into user-friendly formats, demystifying the intricate crypto universe.

Technical Analysis Spotlight: Solana and Cardano

Solana (SOL) — Bullish Consolidation and Potential Upside

Multiple analysts have highlighted Solana’s recent price movements indicating consolidation with bullish undertones. On May 21, 2025, technical chart analyses pointed out a pullback zone around $160 to $164.82, suggesting a temporary dip before the asset rallies higher. This aligns with classic technical behavior where support zones act as launchpads for upward momentum following corrections.

More specifically, a rounded bottom pattern has been identified on the 1-day chart, a formation often interpreted as a reliable reversal indicator signaling confidence among buyers. Price targets in the range of $180 to $200 have been proposed — levels that would mark significant appreciation. This pattern’s emergence reflects Solana’s resilience after facing broader market volatility and points toward renewed investor interest buoyed by network developments and ecosystem expansion.

Cardano (ADA) — Steady Periodic Assessments

Cardano continues to command attention with periodic analyses emphasizing structural stability juxtaposed with cautious optimism. Issue 82 of ADA’s periodic review, freely accessible to the public, underscores methodical evaluation rooted in quantitative financial techniques. Such reports often include moving averages, volume trends, and momentum indicators that collectively frame Cardano’s market behavior.

This focus on rigorous, accessible reporting fosters transparency and educates the community, nurturing informed investment decisions amid fluctuating market conditions. By providing content in multiple languages including Persian, it demonstrates Cardano’s global outreach and commitment to broad-based education.

Momentum in Meme and Tokenized Assets

The cryptocurrency sphere’s diverse tapestry manifests in viral meme tokens and innovative asset classes, such as tokenized animal-themed cryptocurrencies on Solana. While conventional wisdom might downplay these niche tokens, some crypto analysts argue that their undervaluation presents speculative opportunities. With passionate communities and unique marketing angles—such as georgie’s endorsement of a pig-themed token—these assets generate buzz that occasionally translates into price spikes, reinforcing the power of social media-driven momentum.

Furthermore, dogecoin (DOGE), a perennial favorite in the meme token arena, has recently experienced a correction, sliding about 10% but finding firm support around $0.215. This stabilization after a steep drop highlights the significance of key levels that foster trader confidence, preventing prolonged downturns.

Bitcoin’s (BTC) Climactic Movements and Market Sentiment

Bitcoin remains the bellwether of cryptocurrency markets, and its current trading dynamics exemplify a story of volatility interlaced with opportunity. Price action against the USDT pair showcases attempts at breaking resistance near $107.2K. A successful breakout could trigger an extension to roughly $109.9K, while failure to surpass this hurdle might lead to retracements towards supports at $104.9K or $103.3K. This tug-of-war highlights the balance between “smart money” accumulation and profit-taking pressures.

Market commentators emphasize how those attuned to Bitcoin’s technical signals are well-positioned to capitalize on profits, with some praising follower portfolios reaching sizeable gains. It also reaffirms Bitcoin’s role as the linchpin for broader market momentum, where its behavior often cascades to altcoin performances.

Decoding Crypto Market Sentiment and Analytical Voices

Understanding the crypto market’s emotional undercurrent is as crucial as studying candles and indicators. Tools assessing fear and greed indexes alongside social media sentiment analysis have emerged as vital instruments in making contextualized trading judgments. These sentiment indicators capture that often elusive psychological aspect of markets, illuminating when collective mood may be overly euphoric or panic-driven.

Prominent analysts, such as PlanB with his Stock-to-Flow model focusing on Bitcoin’s scarcity dynamics, and Benjamin Cowen, who offers educational content grounded in engineering and metric-based methodologies, continue to enrich the discourse. Their work underscores the intersection of academic rigor and market pragmatism, encouraging investors to blend quantitative reasoning with real-time observations.

Emerging Technologies: AI-Powered Crypto Tracking Platforms

Alongside CMC AI, the advent of platforms like @cookiedotfun, powered by AI to monitor real-time activity of AI agents across cryptocurrencies, represents an exciting frontier. Such technology facilitates real-time insights into decentralized autonomous systems and agent-driven trading, flagging potential airdrops and giving early adopters a speculative edge. This aligns with the concept of an “info-fi supercycle” — a phase where information infrastructure powered by AI accelerates cryptocurrency innovation and adoption. Traders engaging with these platforms symbolize the cutting edge of crypto participation, combining automated analysis with strategic accumulation.

A Snapshot of Trending Tokens

The day’s spotlight on trending tokens features a broad spectrum: Official Trump ($TRUMP), Bitcoin ($BTC), Pi ($PI), Binance Coin ($BNB), and the meme token Pepe ($PEPE) each garnering attention. This diversity manifests the dual market forces of established blue-chip projects and internet culture-driven speculative assets. Watching how these tokens perform can provide insight into where capital flows are headed, be it driven by fundamental on-chain utility or viral hype.

Conclusion: Navigating Complexity with Tools and Insights

The cryptocurrency market in May 2025 embodies a rich tapestry of complexity, opportunity, and uncertainty. The integration of AI tools like CMC AI promises to elevate research capabilities, helping investors and traders sift through overwhelming data with enhanced clarity. Meanwhile, technical analyses affirm that assets like Solana and Cardano are charting interesting trajectories that demand attention.

Meme tokens and novel niche cryptocurrencies highlight the vibrant, if unpredictable, subcultures within the ecosystem. Bitcoin’s ongoing battles near all-time highs remain central to market behavior, symbolizing both potential breakout and retracement zones guarded by key support and resistance levels.

Ultimately, the best approach blends quantitative rigor—using models and sentiment indicators—with qualitative awareness of community dynamics and technological innovation. As smart traders incorporate these multiple lenses, they stand better prepared to harness volatility rather than be buffeted by it.

—

Sources:

– https://coinmarketcap.com/alexandria/article/coinmarketcap-launches-new-ai-powered-tool-cmc-ai

– https://twitter.com/DerinCancar/status/1659647151624034304

– https://twitter.com/MoonRiseTA/status/1659650024249791489

– https://twitter.com/_CryptoZee/status/1659646845608256257

– https://twitter.com/princedigita101/status/1659650990932546049

– https://twitter.com/AiAnalysisGroup/status/1659647265394731009

– https://twitter.com/Favikon_/status/1659650757757459457

– https://twitter.com/Crypto0304/status/1659649951633288192

– https://twitter.com/BccMining/status/1659649451733517830

– https://twitter.com/AfsahrForex/status/1659648317409483265

– https://twitter.com/0m9os/status/1659652215030549505

Each link opens in a new tab to facilitate convenient exploration.