Navigating the Cryptocurrency Market in 2025: Insights from Cutting-Edge Analysis and Emerging Trends

The cryptocurrency landscape in 2025 continues to evolve at a breakneck pace, blending technological advancement, macroeconomic undercurrents, and investor sentiment into a complex digital mosaic. Tweets and snippets from industry experts and market analysts paint a vivid picture of this ecosystem — where smart AI-driven tools, regulatory rumors, historic price milestones, and speculative narratives interplay to shape market dynamics. This report offers a layered exploration of recent developments, analytical methodologies, and key market signals gleaned from the tumultuous but exciting world of crypto.

—

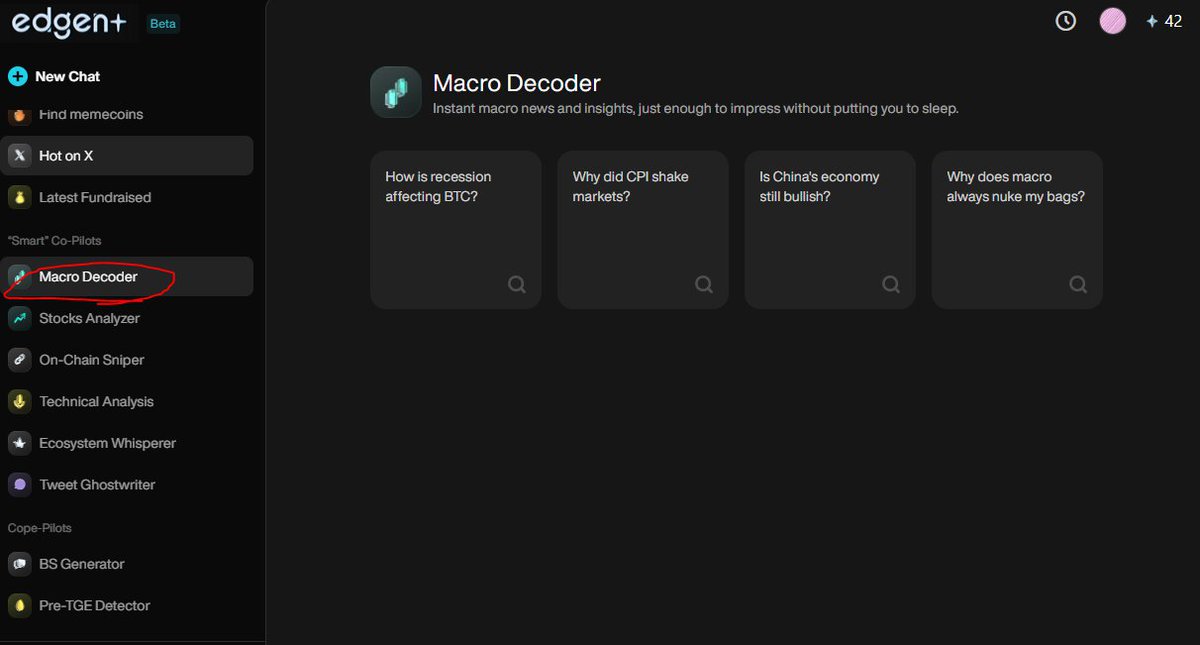

Smart “Co-Pilots” and AI-Powered Market Analysis: The New Age of Crypto Decision-Making

The increasing complexity of the cryptocurrency market demands sophisticated tools that can parse vast amounts of data, both on-chain and macroeconomic. Enter AI-powered “co-pilots” like Macro Decoder and WickrFun, which promise to equip investors with actionable insights by blending traditional economic indicators and blockchain-specific analytics.

– Macro Decoder functions by analyzing macroeconomic trends and significant news events with a laser focus on their impact on crypto assets. This AI-based tool provides a holistic market risk assessment, enabling investors to anticipate shifts prompted by global financial developments or policy announcements[1].

– WickrFun AI Agent is notable for its multi-chain analysis capability, covering networks such as Ethereum, Solana, and Base. By offering cross-chain insights, it caters to diversified portfolios, highlighting opportunities and risks that single-chain analysis might miss[2].

These AI tools underscore an important shift: automated, data-driven analytics are becoming indispensable for navigating the market’s volatility. They are essentially “smart co-pilots” that supplement human intuition with computational rigor, allowing traders to respond more quickly and strategically.

—

The Ripple Effect of Macropolitical Rumors: The Case of Fed Chair Jerome Powell

Rumors around high-profile political maneuvers—such as a possible firing of Fed Chair Jerome Powell by former President Trump—illustrate how intertwined regulatory governance and crypto valuations have become. Markets have reacted sharply to such news, often in the form of short-term “sprees” or correction waves.

Understanding this phenomenon requires a sophisticated lens combining:

– Legal context: The mechanisms and likelihood of such a dismissal happening, including Senate support and precedents;

– Market logic: How investors price policy uncertainty;

– Policy background: Broader monetary policy trends influencing risk appetite.

Such rumors not only create immediate volatility but also force investors to reassess the foundations underpinning crypto as a hedge against traditional finance[3].

—

Bitcoin’s Historic Price Milestone: Beyond $100,000 and Its Gold Parallel

Bitcoin’s recent breach of the $100,000 mark marks not just a numerical milestone but a symbolic narrative shift. Analysts at AstralX have illustrated a fascinating correlation between Bitcoin’s price and the spot price of gold measured at per-kilogram levels — a metaphor that implies Bitcoin is carving out its identity as “digital gold”[4].

This has several implications:

– Value Mapping: The comparison suggests Bitcoin has matured into a serious store of value, meaningful not just to crypto enthusiasts but mainstream asset managers.

– Market Psychology: Investors might increasingly view BTC as a hedge against inflation and economic uncertainty, akin to how gold has been perceived for centuries.

– Volatility Considerations: Unlike gold, Bitcoin’s price remains more volatile and speculative, so the comparison should be seen as aspirational rather than definitive.

—

Crypto Trading Strategies: Support Levels, Liquidity Zones, and Market Sentiment

In shorter-term trading, the importance of identifying and closely monitoring key support and resistance levels is reaffirmed by technical analysts like Ehsan Soltani. For coins such as WLD and POLYX, the fate of trades hinges on whether certain price floors hold during critical 1-hour or 4-hour windows[5][6].

Key concepts emerge:

– Support Levels: These price zones act as psychological anchors where buying interest might prevent further declines.

– Liquidity Collection: Recognizing where institutional or “smart money” may be accumulating helps anticipate breakouts or breakdowns.

– Trade Entry Points: Timing entry relative to these levels is crucial for maximizing returns and minimizing risk.

These insights reiterate that while long-term macro trends dominate headlines, technical analysis remains a vital tool for day-to-day trading decisions.

—

Novel Token Projects and Market Sentiment

The launch and analysis of emerging tokens provide a window into the evolving marketplace. For instance, UMA’s focus on the decentralized exchange token ($LETSBONK) taps into the expanding DEX ecosystem and aligns with growing demand for decentralized finance solutions[7].

Meanwhile, playful narratives emerge around seemingly whimsical tokens like $B=H (Bitcoin equals House), combining humor with valuation to capture “smart money” attention[8].

These cases illustrate two facets of crypto innovation:

– Technical innovation: New projects with explicit utility promise.

– Narrative-driven valuation: How storytelling and market psychology drive interest in assets beyond fundamental metrics.

—

Market Structure and Regulation: The Role of Political Actors

Former financial committee chair McHenry’s commentary about growing bipartisan interest in crypto market structure legislation highlights the regulatory environment’s evolving nature[9]. As crypto attempts to integrate with traditional finance, lawmakers grapple with:

– Creating clarity: Secure frameworks that foster innovation yet protect investors.

– Cross-party consensus: Which signals a maturing political understanding of crypto’s systemic relevance.

– Potential pitfalls: Regulatory uncertainty can still roil markets as investors anticipate shifts.

Crypto stakeholders must continuously monitor regulatory trends to anticipate compliance demands and policy-induced market movements.

—

The Global Rarity of Bitcoin Ownership and Crypto’s Democratization Challenge

Statistics indicating that only 0.27% of the global population owns at least 1 Bitcoin shed light on the persistent concentration of crypto wealth[10]. This raises several discussion points:

– Inequality: Despite crypto’s inclusive ethos, token ownership remains uneven.

– Market implications: Concentration in whales may amplify volatility if large holders act simultaneously.

– Financial inclusion: Mass adoption requires addressing barriers such as education, access, and regulatory hurdles internationally.

Hence, while cryptocurrencies offer promise of decentralization, their adoption still largely reflects broader socioeconomic divides.

—

A Cautionary Reminder from History

Looking back at headlines like “R.I.P Bitcoin. It’s time to move on.” from 2016 serves as a poignant reminder that skepticism and hype have always coexisted in this space[11]. The continued rise to a $100,000+ valuation shows resilience, but also the necessity of critical analysis and cautious optimism.

—

Conclusion: Staying Ahead in a Fluid and Multifaceted Market

The cryptocurrency market in 2025 is a tapestry woven from technological innovation, macroeconomic forces, political developments, and investor psychology. AI-powered analysis tools are transforming how participants digest information, while historic price breakthroughs and regulatory shifts redefine narratives daily.

Investors, traders, and policymakers alike must navigate this nuanced environment using a blend of:

– Data-driven insights,

– Technical analysis, and

– Informed skepticism.

This ongoing journey demands adaptability, critical thinking, and a readiness to engage with the future — one block and one byte at a time.

—

References

[1]: Macro Decoder — AI Market Analysis Tool (Source from @somnia_pang tweet)

[2]: WickrFun AI Agent Multi-chain Analysis (Source from @0xDmitriX tweet)

[3]: Rumors around Jerome Powell related to market impact (Source from @azlY8BBgP399047 tweet)

[4]: Bitcoin price milestone linked to gold prices (Source from @Astral_Global_ tweet)

[5]: Technical analysis of #WLD on 1-hour timeframe (Source from @Rainman_em tweet)

[6]: Technical analysis of #POLYX on 4-hour timeframe (Source from @Rainman_em tweet)

[7]: UMA’s Decentralized Exchange Token Project (Source from @umaonsol tweet)

[8]: Narrative-driven valuation of $B=H token (Source from gmgn.ai token announcement tweet)

[9]: Political engagement in crypto regulation (Source from @CryptoBuletin8 tweet)

[10]: Bitcoin ownership statistics (Source from @CryptoBuletin8 tweet)

[11]: Historical skepticism about Bitcoin (Source from @CryptoBuletin8 tweet referencing The Washington Post 2016)

—

Additional Reading

– Macro Decoder AI Tool

– WickrFun AI Agent on Telegram

– Bitcoin Price and Gold Comparison

– Political Rumors Impacting Markets

– UMA Decentralized Token Project