The recent surge of AI-powered tools and real-time analytics in the cryptocurrency market signals a significant shift in how traders and enthusiasts monitor and engage with digital assets. Among these innovations, the introduction of WickrFun—a multi-platform AI cryptocurrency analysis agent—illustrates the growing fusion of artificial intelligence and blockchain ecosystem insights. Examining this alongside key technical trade analyses and market condition updates reveals a landscape that is both complex and rapidly evolving.

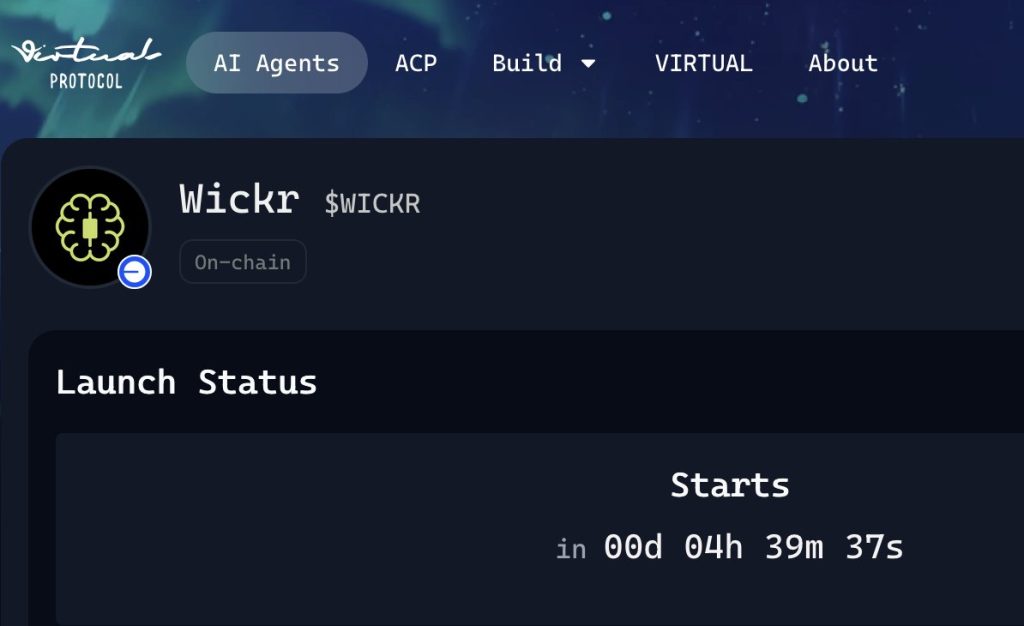

WickrFun: AI Meets Multi-Chain Crypto Analysis

WickrFun’s launch stands out for several reasons. Available on popular platforms like Telegram, Web, Farcaster, and X, it brings AI-powered insights directly to users across communication channels. Incorporating multi-chain analytics, it tracks blockchains such as Ethereum, Solana, and Base, making it possible to receive cross-chain data in a seamless, real-time fashion.

This tool exemplifies the movement toward democratizing crypto data by using AI to simplify and enhance decision-making. Instead of requiring users to manually parse on-chain data or switch between multiple analytics platforms, WickrFun offers an accessible interface for quick, multi-chain intelligence. For retail traders and institutional players alike, such functionalities can reduce investigation time and improve the speed of reaction to market moves.

Technical Levels and Market Sentiment in Focus

Recent trade analysis shared publicly reflects a continued emphasis on classical technical analysis methods fused with modern data interpretation tools. For instance, both the #WLD (Wilder World) and #POLYX liquids revealed key support zones at 1.057 and 0.1554, respectively, in their 1-hour and 4-hour timeframes. These support zones serve as critical decision points—whether the price respects or breaks them could dictate entries or exits from trades.

Such strategic levels, often derived from historical price action, trading volume, and liquidity pockets, remain cornerstones despite the rise of AI. AI enhances these insights by quickly processing vast amounts of real-time data, but the core principle is unchanged: support and resistance still govern moment-to-moment market psychology.

Emerging Tokens and Platform Innovations

Projects like UMA’s DEX Coin and platforms like WEEX show cryptocurrency innovation continuing on multiple fronts. The UMA Alpha report mentioned a decentralized exchange token aiming to expand usability within DeFi. Similarly, WEEX’s push with new features suggests blockchain platforms are racing to evolve, adapting to user needs and competitive landscapes.

These advancements point to a market that is maturing beyond simple token speculation toward robust infrastructure that supports diverse use cases—decentralized finance, trading, data analytics, and community governance, among others.

Market Cap and Overall Sentiment: Bullish Momentum?

One of the most insightful snapshots comes from aggregate market analyses. The total cryptocurrency market capitalization recently broke past an ascending triangle pattern with significant trading volume. Accompanied by a supportive Ichimoku Cloud signal indicating strong bullish momentum, this suggests an optimistic near-term outlook.

Patterns like the ascending triangle reflect accumulation and a forthcoming breakout possibility. The addition of volume strengthens this hypothesis, showing that buyer interest is not dieing out. Technical indicators like the Ichimoku Cloud provide a multi-dimensional measure of trend strength and support/resistance zones, reinforcing confidence in potential upside.

The Human Perspective: Warnings and Wisdom in Waves

Despite all the excitement surrounding new tech and market moves, experts repeatedly display judicious caution. Disclaimers reminding traders that analyses are educational and not financial advice underscore the inherent risks in crypto investing and trading. Volatility, regulatory uncertainty, and rapid innovation mean that even the best AI tools and strategies cannot guarantee outcomes.

Interesting anecdotal elements, such as the playful “1 Bitcoin equals 1 House” valuation narrative for the $B=H token, add a human touch to the otherwise technical discourse. These narratives help frame the crypto market’s cultural fabric where memes, stories, and social sentiment often intersect with market reality.

Conclusion: The Future of Crypto Analysis Is Intelligent and Integrated

The advancements exemplified by WickrFun’s AI agent on multiple platforms mark an important evolution in the crypto space. Combining traditional trade analysis with AI-enhanced multi-chain data creates a potent informational advantage. Meanwhile, the overall market action, reflected through robust bullish signals and attention to key price supports, reveals a crypto ecosystem that is vibrant and actively traders are ready to capitalize on patterns and signals.

The synergy of cutting-edge AI, deep technical analysis, and innovative projects signals that the crypto market of the future will be smarter, faster, and more adaptive. But the reminders about risk and personal responsibility also caution that amidst sophisticated tools, prudence is vital.

As AI tools like WickrFun continue to evolve, the barrier to entry in crypto analytics lowers, empowering more participants to join the market knowledgeably. This democratization, paired with dynamic market conditions and creative new tokens, paints an exciting and complex picture of where crypto is heading next.

—

Sources

– Official Twitter announcements and analyses from DmitriX, Ehsan Soltani, UMA, DYNAMIC TRADE CALLS, and other industry commentators (dated May 19, 2025).

– Market data interpretations from public crypto trading charts and technical indicators like the Ichimoku Cloud.

– Recent project and platform updates from UMA’s decentralized exchange token and WEEX platform innovations.