Navigating the Latest Waves in Cryptocurrency: Insights from May 19, 2025

The cryptocurrency market, ever dynamic and fast-evolving, delivered a series of notable developments and technical analyses on May 19, 2025. From the launch of an innovative AI-powered tool to intricate market movements and policy shifts, the day’s activity offers a layered view of both the state of crypto assets and their future trajectories. This report distills those key moments, interpretative analyses, and broader market implications.

—

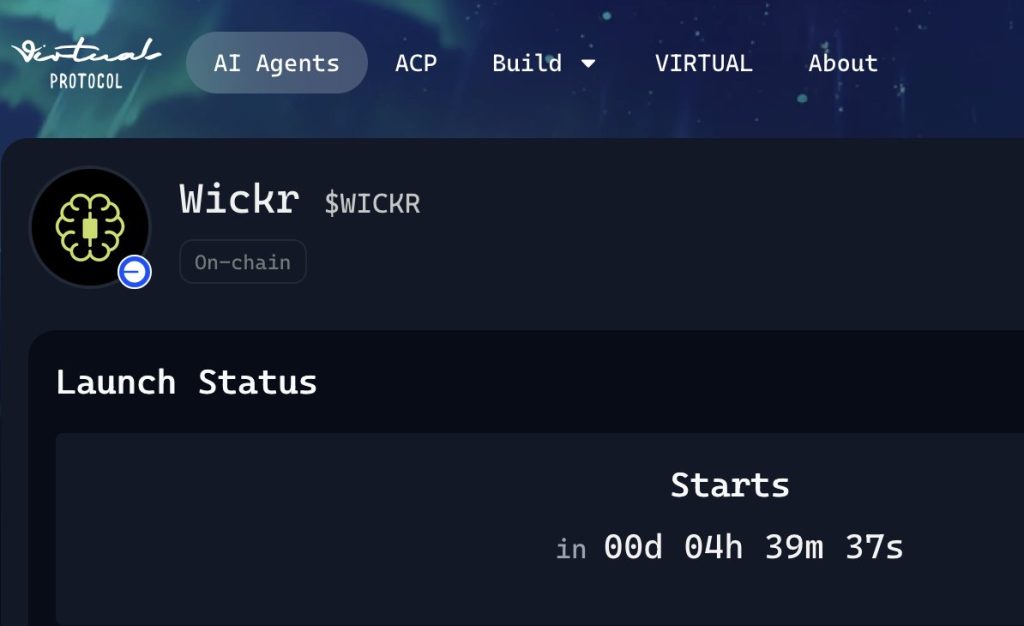

Unveiling WickrFun: The New AI Compass for Cryptocurrency Analysis

An intriguing innovation surfaced with the launch of WickrFun, a multi-platform, AI-driven cryptocurrency analysis tool accessible via Telegram, Web, Farcaster, and X. This agent is poised to reshape how traders and enthusiasts decode blockchain activities by offering multi-chain analysis on prominent blockchains like Ethereum, Solana, and Base.

The value proposition of WickrFun lies in its integration across platforms familiar to crypto users, coupled with the convenience of pasting blockchain data snippets for immediate computational insight. This ease of access hints at a democratization of complex on-chain analytical capabilities, previously limited to specialists with advanced tools.

The timing of this release is significant—amid accelerating blockchain activity and growing demand for transparent, real-time data, AI-assisted tools like WickrFun serve as cognitive aids, helping investors parse the overwhelming volume of information and spot actionable signals efficiently.

—

Technical Pulse: Support Levels, Price Movements, and Trade Signals

Several seasoned analysts shared critical evaluations of various coins, offering a glimpse into the short- and medium-term technical dynamics:

– WLD (1-hour timeframe): The key support level around 1.057 is under watch. The behavior here will determine trade entry points, underscoring how minute shifts in price can pivot market sentiment and participant behavior.

– POLYX (4-hour timeframe): Approaching a support base near 0.1554, traders are advised to monitor whether this floor holds or breaks. Such levels often represent psychological and institutional interest zones, dictating the probable direction of the asset.

– DYDX: In a descending price structure, the asset recently saw local corrections to support levels, and now liquidity is clustering around these zones, suggesting potential volatility ahead. The expectation is a breakdown followed by a corrective phase, a classic trading pattern.

– BTCUSDT (4-hour timeframe): Bitcoin flirted with resistance around 104.5K but failed to surge past it, indicated by a rejection wick on the chart. A break below the 100K support might lead to a deeper retracement toward roughly 93,834 – a crucial observation for those managing portfolio risk and exposure in a high-stakes environment.

What ties these analyses together is the centrality of support and resistance levels as navigational beacons in the chaotic seas of crypto trading. Recognizing when these levels hold or fracture is key for timing entries and exits, as highlighted by seasoned traders.

—

Broader Market Dynamics: Bullish Momentum and Macro Influences

On a macro scale, the total cryptocurrency market cap has made a compelling move past an ascending triangle pattern with substantial volume support, entering a retesting phase backed by bullish signals including an encouraging Ichimoku Cloud scenario. This technical formation and momentum reinforce the upside potential despite inherent market volatility.

Policy shifts also pepper the landscape:

– A Trump tax cut bill advances through the House of Representatives, an event closely watched for its economic ramifications.

– The U.S. Treasury Secretary’s attendance at a G7 Finance Leaders’ Meeting focuses attention on trade dynamics, which can influence capital flows and regulatory approaches affecting crypto markets.

Such political-economic developments underscore how cryptocurrency is embedded within broader global financial systems, sensitive to legislative and diplomatic movements beyond just tech and market forces.

—

Emerging Themes and Market Sentiment

Several threads emerge from the diverse commentary:

– The growing narrative evaluating Bitcoin’s value proposition, notably playful comparisons like “1 Bitcoin equals 1 House”, reflect innovative perspectives aiming to contextualize crypto’s purchasing power and real-world relevance.

– The continued interest in decentralized exchange tokens (DEX coins), as seen with projects like the Decentralize Exchange launching DEX Coin, points to evolving infrastructure that promotes self-sovereign trading environments and liquidity sharing.

– Market participants express a blend of wariness and opportunity-seeking around price corrections, with some interpreting recent candle patterns as perfect moments to expand positions rather than retreat — a hallmark of bullish conviction amidst uncertainty.

– The presence of smart money buying alerts and analyses signaling accumulation phases suggests that despite headline volatility, sophisticated investors might be quietly positioning for a longer-term upswing.

—

Wrapping Up: Reflecting on What May 19, 2025 Revealed

Cryptocurrency is clearly not a static landscape. The launch of AI-driven analytical tools like WickrFun signals an evolution toward more accessible, granular, and multi-chain intelligence gathering—a necessary adaptation as market complexity deepens.

Concurrent technical analyses reinforce that while macro bullish momentum pulses strongly, micro-level price action remains nuanced and requires attentive monitoring of support/resistance pivots. Traders who marry this granular vigilance with an understanding of the broader political-economic context stand the best chance of navigating future volatility successfully.

Looking ahead, the convergence of AI, decentralized finance products, evolving regulatory frameworks, and market sentiment narratives suggests that 2025 will be a year marked by rapid innovation intertwined with strategic recalibrations. For investors and enthusiasts alike, remaining informed, adaptable, and critical will be the keys to thriving amidst crypto’s ever-shifting tides.

—

Sources

– WickrFun launch announcement on Twitter

– Market analyses from Ehsan Soltani (@Rainman_em) on Twitter

– UMA’s DEX Coin project insights on Twitter (@umaonsol)

– Cryptocurrency market cap and technical interpretations by DYNAMIC TRADE CALLS (@Ben_smithscott5)

– Macro policy updates from AstralX (@Astral_Global_)

– Various trade and analysis tweets by Vaibhav Mahadkar (@CryptoBuletin8) and George Samaropoulos (@GSamaropoulos)

*Note: All links open in new tabs.*