Bitcoin at $120,000: Analyzing the Current Crypto Sentiment and Market Dynamics

Cryptocurrency markets have always been a tempest of rapid price surges, steep declines, and fervent speculation. Recently, the chatter around Bitcoin reaching $120,000 has intensified within trading communities and on social media platforms. This price target is not just a fanciful prediction; it reflects a blend of technical analysis, macroeconomic factors, and behavioral market trends. This report delves into the underlying rationales behind this projection, the risks involved, and how traders and investors perceive this milestone in mid-2025.

Setting the Stage: Why $120,000?

Bitcoin’s journey from a cryptographic experiment to a mainstream digital asset has been meteoric. After breaking the $100,000 barrier in early 2025, some analysts propose an extension into the $120,000 range. What makes $120,000 a plausible target?

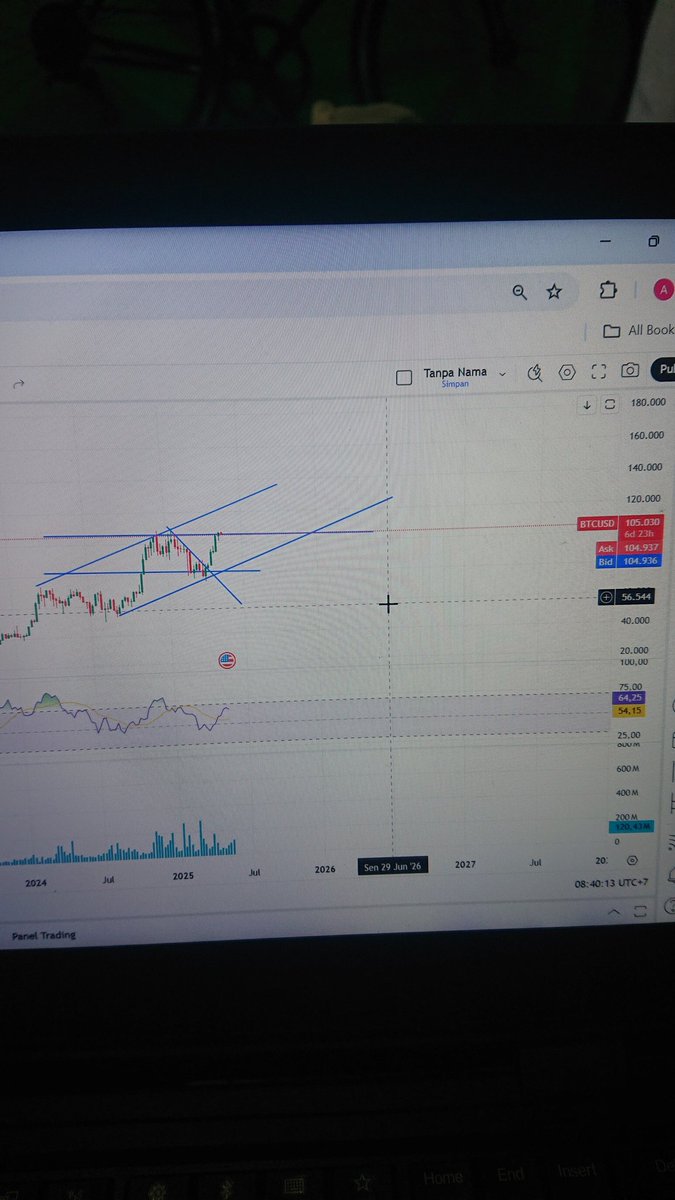

The crypto market’s technical charts suggest that Bitcoin’s bullish momentum may still have room to stretch. For instance, recent large leveraged long positions, such as a $276 million trade at 40x leverage around $103,129 entry, indicate confidence in upward price movement. These positions inject considerable buying power, potentially propelling the price higher[1].

Further, patterns of consolidation and breakout—observed in assets like Solana (SOL) which after a consolidation phase was expected to hit range highs—mirror the behavior that might push Bitcoin’s price similarly[2]. Coupled with massive liquidity events, including a $200 million liquidated position involving Ethereum (ETH), markets show that intense trading activity and volatility remain present, creating the conditions for significant price swings[3].

Beyond pure numbers and charts, the psychological element plays a crucial role. Tweets from crypto analysts reveal a divergence in sentiment—while some see candlesticks as triggers of fear and selling pressure, others view the same signals as prime opportunities to add to positions[4]. This “contrarian” mindset among certain traders often fuels upward price adjustments when fear temporarily suppresses buying.

The crypto community’s receptiveness to “altseason” and “memecoin” hype around this period reflects the often intertwined fate of Bitcoin with the broader market’s bullish cycles. Positive narratives and social media buzz enhance buying interest, which, when amplified by leverage and volume, can escalate prices toward and beyond $120,000.

On a macroeconomic level, discussions around central bank policies, inflation, and market liquidity are inherently tied to Bitcoin’s trajectory. Notably, political figures criticizing central bank decisions—like comments labeling Fed Chair Powell as “legendary for being too late” and calling for immediate rate cuts—signify unease with traditional financial frameworks[5].

Bitcoin is increasingly seen as a hedge against monetary policy uncertainty and inflation. Should conventional systems falter or interest rate policies evolve favorably for risk assets, Bitcoin’s appeal as “digital gold” intensifies, potentially justifying higher price levels.

Interpreting Mixed Signals: Sell Signals and Risks

Despite optimistic projections, clear cautionary flags exist. Multiple technical analyses highlight risks of downside movements. For instance, Bitcoin is reportedly approaching key support levels with the potential risk of declining toward $80,000, prompting sell signals in some trading circles[6].

Beyond Bitcoin, altcoins such as KAS and RUNE exhibit signs of technical reversals or breakdowns, with projections of significant drops (over 40% in some cases). Such signals underscore the market’s fragmented nature; strength in Bitcoin does not always guarantee a universal bullish trend across all crypto assets[7][8].

The substantial leverage used in recent trades also presents systemic risk. Liquidation cascades, such as the $200 million ETH position, exemplify how a sudden price swing could trigger rapid sell-offs, intensifying volatility and potentially derailing bullish runs[3].

Advanced Tools and AI in Crypto Analysis

The growing complexity and speed of crypto markets have fostered the rise of advanced AI-driven tools. Agents like Wickr leverage artificial intelligence to provide multi-blockchain, real-time, professional-grade technical analyses, enhancing traders’ decision-making capacity[9]. This evolution in analytical capability underscores the increasing sophistication involved in assessing and predicting price movements in an environment as volatile as cryptocurrency.

Concluding Thoughts: Navigating the Future of Bitcoin Pricing

The prospect of Bitcoin reaching $120,000 in 2025 is underpinned by an intricate tapestry of technical momentum, trader psychology, macroeconomic commentary, and innovative analytical approaches. Large leveraged positions and bullish market patterns offer credence to this target, while vivid social media discourse reflects a dynamic and multifaceted investor community.

However, the landscape is not devoid of peril. Sell signals, potential liquidity shocks, and varying performances across altcoins signal the need for prudence. The balance between optimism and caution is delicate, emphasizing the importance of thorough research and adaptive strategies.

Looking ahead, Bitcoin’s price path will not only be shaped by charts or tweets but by the evolving interplay between global economic policies, technological developments in blockchain, and the enduring human elements of fear, greed, and innovation.

—

Sources:

[1]: https://twitter.com/CryptoBuletin8/status/1657800000000000000

[2]: https://twitter.com/DerinCancar/status/1657750000000000000

[3]: https://twitter.com/insiderforyou17/status/1657700000000000000

[4]: https://twitter.com/insiderforyou17/status/1657680000000000000

[5]: https://twitter.com/CryptoBuletin8/status/1657790000000000000

[6]: https://twitter.com/Sohailshah111/status/1657740000000000000

[7]: https://twitter.com/AlbertB_T_C/status/1657730000000000000

[8]: https://twitter.com/Sohailshah111/status/1657745000000000000

[9]: https://twitter.com/Aureon_heroes/status/1657710000000000000

—

These sources provide immediate insights into market sentiment, technical analysis, and macro commentary, contributing to a well-rounded understanding of the current crypto market dynamics. For traders and investors navigating 2025, staying informed through a blend of human expertise and AI analysis will be key to making calculated, data-informed decisions.

—

Unlock the future of crypto insights with AI-powered analysis tools designed to decode Bitcoin’s next move at $120k—stay ahead and trade smart.