Navigating the Cryptocurrency Market: Insights from May 18, 2025

The cryptocurrency landscape never fails to intrigue, bewilder, and excite investors, traders, and enthusiasts alike. The diversity of opinions, the speed of changes, and the fusion of technology with finance continuously reshape the landscape. Today’s cluster of social media insights and market data from May 18, 2025, presents a vivid cross-section of the current crypto sphere, illuminating innovations, market trends, key assets, and the growing regional influence of blockchain. Let’s dissect the data and developments guiding today’s crypto discourse.

—

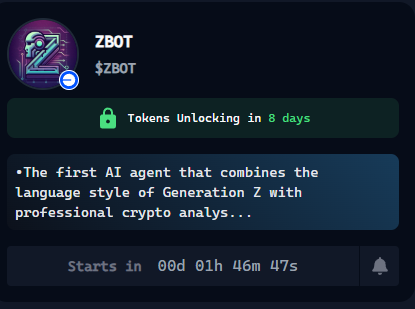

The Rise of AI in Crypto Analysis: Introducing $ZBOT

One standout highlight is the launch of $ZBOT, an AI-driven analytical tool designed specifically within the ethos and language style of Generation Z. $ZBOT breaks from the formal and sometimes opaque style of traditional crypto analysis, offering insights generated by AI with a fresh, relatable tone. This fusion of advanced technology with cultural relevance may address two key industry needs:

This approach might set a new standard for crypto tools, reducing the barrier to entry while enhancing decision-making for traders and holders who previously relied on cumbersome or overly technical reports.

—

Market Dynamics: Bitcoin, Ethereum, and Emerging Tokens

Bitcoin and Ethereum Market Fluctuations

Bitcoin (BTC), still reigning as the dominant cryptocurrency, demonstrated modest volatility with prices hovering around $102,000 to $103,600 — experiencing swings both upward and downward within a short span. Ethereum (ETH), a critical player with its smart contract capabilities and decentralized applications (dApps) ecosystem, showed a similar pattern with prices fluctuating between approximately $2478 and $2610.

These price movements reflect the persistent tension in the market caused by macroeconomic factors, trader sentiments, and shifts in investor focus. The volatility illustrates the ongoing dance between bullish optimism and bearish caution.

Ethereum Classic (ETC): An Emerging Contender

Ethereum Classic (ETC) gains particular attention with prices in the $18-$18.39 range, marked by commendable market stability and growth prospects. Unlike its original Ethereum counterpart, ETC maintains a strict adherence to the original blockchain, appealing to purists and those skeptical about protocol changes.

The increasing interest in ETC signals a diversification of investment strategies beyond the dominant blue-chip cryptocurrencies. Investors view ETC’s steady performance as a beacon for more conservative growth within the altcoin market.

New Entrants and Microcaps: The Case of $MART

New tokens, such as Game Mart ($MART), launched less than an hour ago at a modest market cap of around $352.7K, showcase the vibrant landscape of crypto innovation. With an opening volume of $18.1K and notable buy activity, $MART suggests early traction in the gaming sector—a niche that continues to fuse blockchain technology with interactive entertainment.

Such emergent tokens offer high-risk, high-reward opportunities, often attracting speculative investors betting on the next breakout project.

—

Technical and Sentiment Analysis Across the Board

Technical analyses of various altcoins and Real-World Assets (RWA), like those provided by influencers discussing $OM, reflect ongoing interest in incorporating tangible asset backing into crypto portfolios. These analyses often focus on support and resistance levels, volume trends, and momentum indicators that provide traders with potential entry or exit points.

Additionally, sentiment analysis derived from hashtags and social engagement shows a palpable excitement around “Altseason2025,” implying a bullish expectation on non-Bitcoin assets. This optimism aligns with diversified portfolio strategies and the search for alpha beyond mainstream coins.

—

Blockchain Gaming and Regional Expansion: Vietnam as a Case Study

Vietnam emerges as a significant player in the global blockchain market, ranking 5th worldwide with nearly 17 million crypto owners and $105 billion in blockchain capital invested as of 2023-2024. The country’s enthusiasm for blockchain gaming, especially play-to-earn models, places it at the forefront of a niche that merges gamification with decentralized finance.

The analysis of OP Succinct’s application in Vietnam’s gaming sector highlights regional adaptation and innovation. This localized adoption fosters blockchain technology’s real-world utility by integrating community participation, financial incentives, and entertainment.

Further strategic partnerships, such as those between HCCVenture and Cryptocom Exchange, emphasize coordinated efforts to deepen crypto infrastructure and market opportunities within Vietnam, reinforcing its growing importance in the global blockchain ecosystem.

—

Security and Market Safety: Tips from Influencers

Security remains a paramount concern. Advice shared by prominent figures, including CZ (presumably Changpeng Zhao of Binance), emphasizes vigilance against phishing and other cyber threats. The reiteration of risk disclaimers among analysts points to an acute awareness of the market’s speculative nature and the responsibility of individuals in safeguarding their digital assets.

Risk management and education continue to be pillars supporting the sustainability and maturity of the cryptocurrency market.

—

The Bigger Picture: Market Sentiment and Future Outlook

The crypto market heatmaps and fluctuating asset prices represent more than mere numbers—they sketch a narrative of uncertainty tempered by innovation and adaptation. The interplay between established coins like Bitcoin and Ethereum, emerging altcoins such as Ethereum Classic and Game Mart, and the integration of AI tools like $ZBOT underscores a dynamic, layered ecosystem.

Moreover, the ever-increasing engagement of specific regions like Vietnam reflects crypto’s transition from niche technological phenomenon to broad socio-economic force. As blockchain integrations deepen into entertainment, finance, and cross-border commerce, the crypto narrative will evolve, demanding tools, insights, and communities that keep pace with its complexity.

—

Concluding Thoughts: Embracing the Crypto Era with Eyes Wide Open

The snapshots from May 18, 2025, reveal a cryptocurrency market vibrant with innovation but still laced with risk and volatility. Technologies like $ZBOT exemplify how AI and cultural relevancy can democratize access, making crypto less cryptic for newcomers. Meanwhile, the ongoing success of Bitcoin, Ethereum, and altcoins demonstrates that while the market is volatile, it is far from settling.

Investors and enthusiasts must remain adaptable, security-conscious, and informed—leveraging new tools and regional trends to make savvy decisions. As blockchain technology further embeds into daily life and economies, the challenge will be balancing excitement for new opportunities with disciplined risk management and a critical eye.

In this era of rapid change, the best strategy may be to remain curious and cautious, embracing innovation without losing sight of the fundamentals.

—

Sources and Further Reading

– Virtuals.io – About $ZBOT

– ETC Nexus – Ethereum Classic Market Updates

– Solana CT Scanner – Token Launch Data

– Vietnam Blockchain Market Analysis

– Crypto Market Heatmaps by Vaibhav Mahadkar

– CZ’s Security Tips

*(Note: URLs provided lead to live pages for real-time information purposes and open in new tabs.)*