Analyzing the Current State of Bitcoin and Cryptocurrency Markets in 2025

Introduction: The Cryptocurrency Landscape in 2025

As we progress through 2025, the world of cryptocurrencies presents a dynamic and rapidly shifting landscape. Bitcoin, the flagship digital asset, continues to captivate investors, institutions, and global governments alike. Headlines and analyses flood social media and financial news outlets, reflecting both exuberance and caution. From technical chart predictions to political shifts, the narrative today is layered with signals that hint at a significant phase in Bitcoin’s journey and the broader crypto ecosystem.

The overarching theme in 2025 seems to revolve around a confluence of technical milestones, regulatory developments, and macroeconomic factors, all intertwined to influence Bitcoin’s trajectory. Whether it’s technical indicators pointing toward wave completions, regulatory actions like Missouri’s tax moves, or predictions of unprecedented price levels, the narrative is complex yet rooted in tangible data and evolving market psychology.

This report delves into the current state of Bitcoin, assesses the technical analysis, considers macro and regulatory factors, and questions the sustainability of such bullish predictions. Our goal is to provide a holistic, yet clear, understanding of where Bitcoin stands today and the possible paths forward.

Technical Analysis: Waves, Levels, and Indicators

Elliott Wave and Market Structure Signals

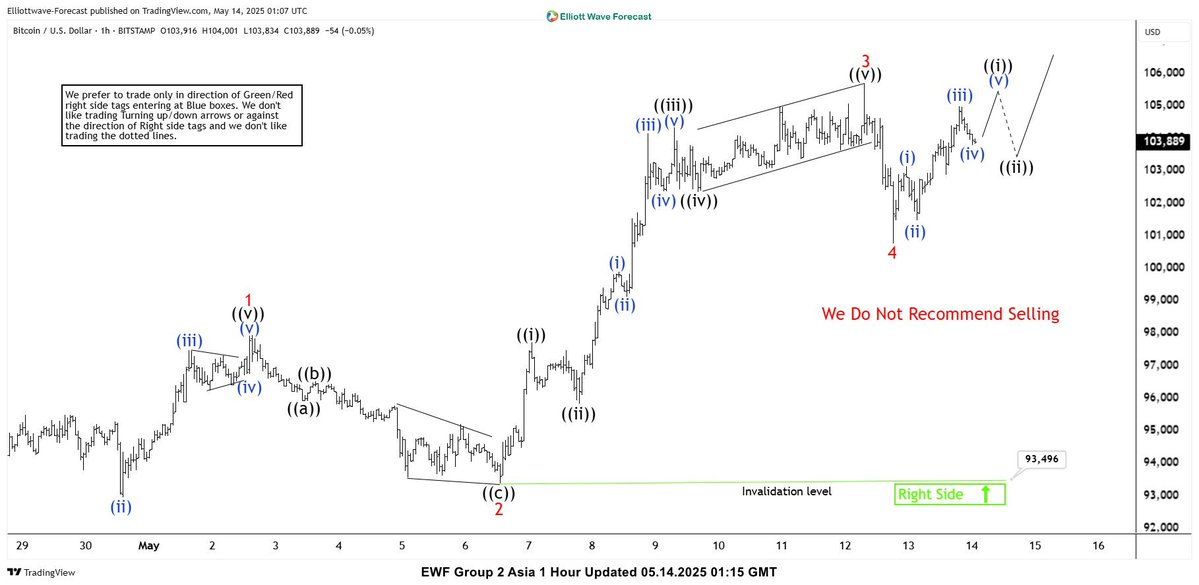

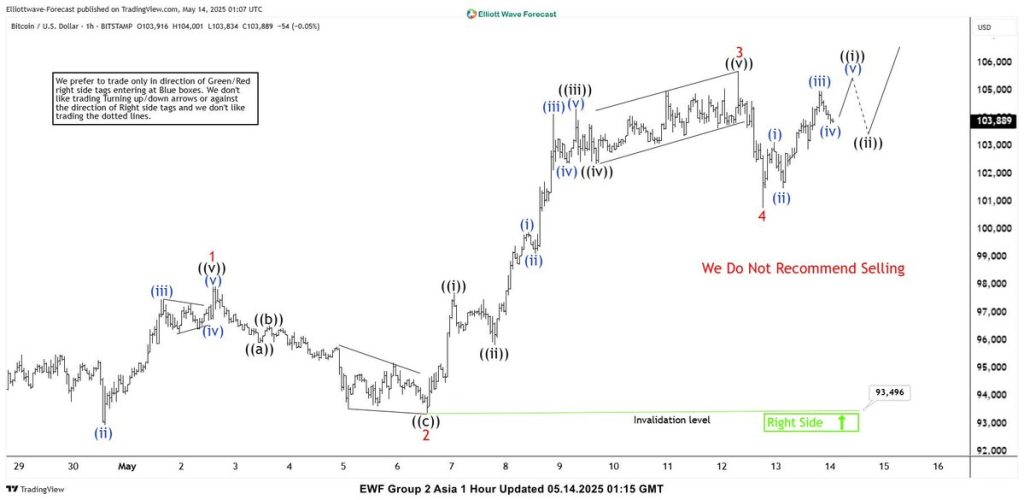

One of the prominent technical perspectives cited is the Elliott Wave analysis suggesting Bitcoin is nearing the completion of Wave 3 in a five-wave impulse pattern. This pattern is fundamental in technical analysis, often indicating a trend’s maturity and potential reversal zones.

According to analysts at Elliottwave Forecast, Wave 3 — historically the most explosive — is approaching its top. This could mean that current bullish momentum might pause or consolidate before the next move, typically Wave 4 correction, followed by Wave 5 of the impulse wave. Such formations hint at underlying investor psychology shifting from euphoria to caution before perhaps another leg higher or a correction[1].

Implications of Wave Completion: The nearing completion of Wave 3 generally precedes a corrective phase, which might serve as an opportunity for informed traders to reassess positions or anticipate a dip.

Key Price Levels and Consolidation

Recent price movements show Bitcoin consolidating between approximately $100,900 and $105,800 after a notable rally began on May 9. These ranges suggest a market awaiting new catalysts, with traders carefully watching for breakouts or breakdowns from critical support and resistance levels.

Some analysts have provided specific targets based on Fibonacci extensions and technical models, proposing potential upside prices around $214,920 (top cap), indicating a near 387% upside from current levels in optimistic scenarios[2].

Volume and Supply Dynamics

Another important technical indicator is the drop in Bitcoin exchange supply by 3.9% following the crossing of the $100,000 mark. Reduced supply on exchanges often signals that holders are consolidating or opting to hold rather than sell, which can underpin bullish trends. This dynamic might fuel further upward movement as scarcity effects kick in.

Market Sentiment and Overbought Levels

Despite bullish forecasts, charts on daily and weekly scales are approaching overbought zones. Sensible traders keep a close eye on such indicators, warning that a reversal or correction could be imminent if these levels are challenged. Some strategists recommend taking profits near current levels, emphasizing risk management.

Sentiment Metrics: Fear and Greed Index

Behavioral analysis, such as the Fear & Greed Index, suggests investor sentiment currently leans toward excessive greed, typical of late-stage bull markets. While greed can propel prices higher, it also warns of potential sharp corrections if investors start to take profits en masse.

—

Macro and Regulatory Factors Shaping 2025

Political Endorsements and Regulatory Moves

In 2025, significant political signals have emerged, influencing the crypto markets significantly. For instance, President Trump’s claim that the U.S. leads China in crypto indicates a shift towards a more assertive U.S. stance, possibly signifying advancements or increased acceptance of crypto assets at policy levels[3].

A landmark regulatory development is Missouri’s decision to abolish capital gains taxes on Bitcoin, XRP, stocks, and real estate. This move makes the state uniquely attractive for crypto investors and could set a precedent for nationwide policy changes, encouraging more digital asset adoption and institutional interest[4].

Institutional Adoption and Market Infrastructure

Market infrastructure developments continue to enhance Bitcoin’s credibility. The movement of projects like Aavegotchi from Polygon to Base in April signifies ongoing efforts by DeFi projects to diversify and optimize blockchain deployment. Such shifts reflect maturation within the ecosystem, potentially leading to increased liquidity and usability.

Geopolitical and Economic Feedback Loops

The global macroeconomic climate remains a crucial influence. Factors like inflation, currency devaluations, and geopolitical tensions function as tailwinds or headwinds for Bitcoin. The AI-driven forecast predicting Bitcoin hitting $250,000 in 2025 is based on models considering supply constraints, increased institutional holdings, and macro uncertainties[5].

While ambitious, such predictions should be tempered with caution as market volatility persists, and unforeseen geopolitical or financial shocks could alter trajectories.

—

Broader Market Trends and Altcoin Dynamics

Altcoin Season and Bitcoin Dominance

Analysis points to a declining Bitcoin dominance chart and rising Ethereum (ETH) towards all-time highs (ATHs), signaling a broader altcoin season. As Bitcoin’s market cap share diminishes from peaks, investors diversify into altcoins like ETH, Solana, Binance Coin, and others, often accelerating returns and broadening market participation[6].

The narrative here is that altcoin dominance indicates robustness across the entire crypto sector, often driven by innovative upgrades, protocol upgrades, or emerging use cases.

Speculative Phenomena and Social Engagement

Social media buzz and meme coins like FLOKI and PEPE continue to fuel attention and retail speculation. Limited-time offers, such as Binance’s “red packets,” provide small incentives for user engagement but also reinforce the speculative nature of the market.

Market Risks: Shorts, Failures, and Overleveraging

Contradictory signals emerge with reports highlighting failed short positions—like the loss by a trader who shorted MsTR—and the risk of overleveraged positions exacerbating volatility. As markets approach overbought levels, a sudden reversal driven by profit-taking could lead to sharp corrections.

—

Critical Perspectives and Skeptical Analysis

The Overoptimism of Price Predictions

While AI and technical models predict Bitcoin reaching $250,000, such forecasts require cautious optimism. Historically, markets have failed to materialize such forecasts within designated timespans, and macroeconomic shocks or regulatory clampdowns could derail even the most optimistic projections.

The Role of Institutional Involvement

Although institutional interest is growing, some skeptics point out that regulatory crackdowns, banking reluctances, and geopolitical tensions could hinder adoption. The notion of the U.S. leading China in crypto is significant but may be overly optimistic considering China’s ongoing centralized digital currency initiatives[7].

Market Volatility and Investor Psychology

The current market dynamics suggest a classic “euphoria” phase, often followed by corrections. The combination of technical overbought signals and behavioral metrics calls for prudence among traders and investors. FOMO-driven behaviors can inflate bubbles, which later burst unpredictably.

—

Conclusion: Navigating the Uncertain Future

Challenges and Opportunities Ahead

The year 2025 stands as a testament to the evolving complexity of cryptocurrencies. Technical signals suggest Bitcoin is approaching a critical juncture—potentially a peak of Wave 3 of an impulsive structure—yet fundamental developments and macroeconomic factors could favor continued growth or trigger corrections.

Opportunities include the possibility of significant price gains fueled by scarcity, institutional adoption, and favorable regulatory policies. The Missouri tax abolition and hypergrowth forecasts underscore political and macroeconomic tailwinds.

Risks involve overextension, macro shocks, regulatory restrictions, and behavioral pitfalls like FOMO. Skeptics rightly warn against overconfidence in predictions of $250,000 or higher without considering potential setbacks.

Final Reflection: The Future of Bitcoin in 2025

Will Bitcoin fulfill the ambitious visions of reaching hundreds of thousands of dollars? Perhaps. Or will it serve as a volatile asset reflecting broader economic tensions, regulatory uncertainties, and investor sentiment swings? The journey is as much about navigating risks as capitalizing on opportunities.

What remains clear is that Bitcoin and the broader crypto ecosystem are entering a phase of intense maturation—where technical, political, and psychological factors intertwine in shaping the horizon. For investors, traders, and observers alike, staying informed, adaptable, and cautious will be the keys to withstand and thrive amidst the volatility.

—

References

—

*Disclaimer: The information in this report is derived from publicly available social media and news sources as of May 14, 2025. It aims to provide analytical insight, not investment advice. Always do your own research before making financial decisions.*