Analyzing the Ever-evolving Terrain of the NFT and Cryptocurrency Ecosystem in 2025

In the bustling digital marketplace of 2025, the realm of non-fungible tokens (NFTs), DeFi, whales’ activities, and blockchain analytics continues to expand with remarkable dynamism. The year propels us into an era where blockchain transparency, engagement, and innovation are the central themes shaping the future of assets, investments, and communities. This report dissects recent trends, tools, and incidents across these sectors, shedding light on market health, potential manipulations, technological advancements, and community sentiment that define the 2025 landscape. Through a comprehensive analysis rooted in on-chain investigations, market insights, and technological developments, I aim to offer an engaging yet precise guide to understanding where the industry stands today.

The Deep Dive into On-Chain Analytics and Investigations

Unmasking Wash Trading in NFT Collections

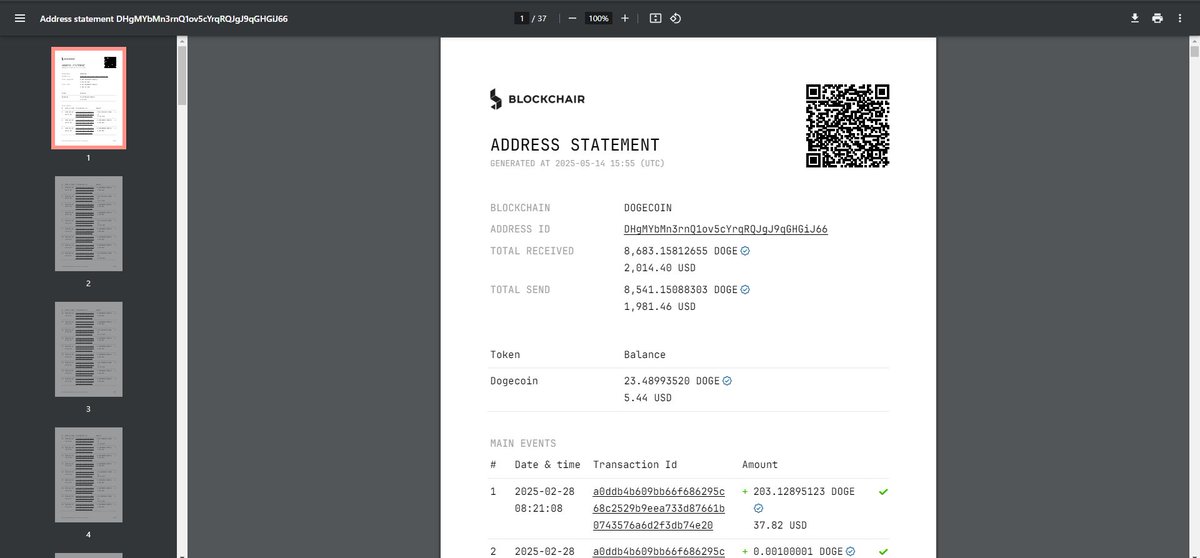

In the first notable event, an investigative tweet references a suspected wash trading scheme involving a wallet, DHgMYbMn3rnQ1ov5cYrqRQJgJ9qGHGiJ66, within the Natdog NFT collection. Wash trading—which involves buying and selling an asset to artificially inflate its value—has persisted as a challenge for ensuring transparency in NFT markets. According to blockchain analysis, these malicious practices compromise trust and distort true market demand.

The investigation aimed to scrutinize wallet transaction history on platforms like Doginals (see NatDogs NFT Transactions). Blockchain analysis tools examine transaction patterns, frequency, and wallet connections to detect anomalies characteristic of wash trading—such as rapid, repetitive transfers between related accounts without legitimate market movement. Such deep on-chain scrutiny reveals how illicit actors manipulate markets, creating artificial hype around NFTs, leading to inflated valuations and potential pump-and-dump schemes. This highlights the necessity for robust analytics and community vigilance to safeguard market integrity.

The Power of Wallet Score Trackers and Whalewatch Tools

A related tweet queries the most-utilized features in platforms like MagicNewton, including the Wallet Score Tracker and Whalewatch. These tools serve as the backbone of on-chain transparency: the Wallet Score assesses the health and credibility of a wallet based on activity, history, and associated addresses, while Whalewatch provides insights into large holder activities—often termed ‘whales’—whose movements can significantly influence market trends.

In practice, these tools help traders and investors identify ‘smart money,’ anticipate large transfers that could precede market moves, and detect potentially manipulative behaviors. For example, an unusually high concentration of assets moving in or out of a wallet can indicate possible market manipulations like front-running or strategic accumulation/distribution. As these tools advance, especially with AI integrations, they are becoming vital for maintaining market fairness and making informed decisions.

NFT Market Sentiments and Community Trends

The broader narrative within 2025 also incorporates community sentiment and market shifts, exemplified by events such as “NFT’s Doing a Comeback?”—highlighting a revival in NFT trading interest. Analysts and influencers assert that market enthusiasm is resurging, partly driven by value rediscovery, technological improvements, and increasing mainstream acceptance. Platforms like GravityX are actively discussing trending stories, technical analyses, and undervalued coins, symbolizing an ecosystem self-reinforcing confidence.

Additionally, tools for market sentiment analysis, like Soon’s sentiment analyzers, are gaining prominence by quantifying community mood, optimism, and speculative behavior. Such insights allow creators, traders, and analysts to gauge whether the hype is sustainable or inflated, reducing the risk of bubble bursts.

Innovation and Ecosystem Expansion in 2025

The Rise of Omnichain NFT Marketplaces and Interoperability

One of the most fascinating developments this year is the integration of omnichain platforms like Monad Ecosystem’s new projects. They aim to facilitate NFT trading seamlessly across multiple chains such as Ethereum, Solana, and others—enabling cross-chain liquidity and user experience. By positioning as a true omnichain marketplace, these platforms eliminate fragmented liquidity pools and open new avenues for creators and collectors.

This push for interoperability responds to the community’s demand for fluid asset transfer, allowing artists to showcase their work across various chains and investors to capitalize on arbitrage or liquidity gaps. Such systems, often powered by decentralized protocols, also involve complex smart contracts that guarantee security and transparency across chains, nudging the entire industry toward a more unified ecosystem.

NFT Market Metrics and Data-Driven Insights

Tools like BitsCrunch’s UnleashNFTs exemplify a trend towards granular NFT valuation based on rarity attributes. This method moves beyond floor prices and volume metrics, incorporating advanced AI-infused analysis of individual traits, rarity, and uniqueness—attributes that greatly influence an NFT’s desirability and value. For instance, a digital artwork containing rare traits can be objectively valued higher than common ones, assisting investors in making more precise decisions.

Moreover, daily market sentiment tools, like those developed by Soon, provide creators and collectors with insights into current market stability, activity levels, and community mood. Such data aid in timing entry and exit points, understanding the market’s pulse, and avoiding speculative pitfalls.

The Emergence of Cross-Chain Identity and Data Ownership

SuiLink, a novel identity linking protocol, exemplifies a significant movement to unify user identities across chains like Sui, Ethereum, and Solana. This approach caters to enhanced security, privacy, and user ownership of personal data. It also paves the way for innovative use cases such as airdrops, loyalty schemes, and targeted campaigns, thus tackling one of the long-standing challenges—technology standardization and user-centric data control.

Threshold campaigns using SuiVRF or linked account analysis empower startups and entities to launch targeted promotional campaigns, token airdrops, or loyalty programs with greater efficiency, ensuring rewards reach genuine users while reducing fraud.

The Market’s Resilience and Growth Catalysts

The Surge of Ethereum and the Broader Ecosystem

In May 2025, Ethereum’s rally to around $2700 reflects broader macroeconomic factors, technological upgrades, and increasing DeFi and NFT activity. As observed in recent analyses, the Ethereum ecosystem is experiencing explosive growth driven by institutional interest, scaling solutions, and innovative projects. Reports from entities like Harspider Capital highlight the importance of understanding underlying factors like macroeconomic tailwinds, DeFi evolution, and NFT market recovery.

Macrofinancial Trends and Institutional Interest

The macroeconomic environment continues to influence the crypto landscape substantially. The expansion of ETF products, improved compliance standards, and institutional adoption create a positive feedback loop. Meanwhile, decentralized projects like RhinoAnalysis monitor economic indicators, macro tailwinds, and technical levels, informing strategic positioning for investors.

Cross-Chain and Omnichain Opportunities

The multi-chain environment, driven by protocols that facilitate frictionless cross-chain transactions and identity management, broadens the horizon for new projects and investments. It addresses liquidity fragmentation, reduces slippage, and democratizes access to high-value assets—contributing to a more resilient and inclusive ecosystem.

Challenges and Ethical Considerations in 2025

Market Manipulation and Fraudulent Practices

Despite technological advancements, malicious actors continue to exploit vulnerabilities. Wash trading, front-running, and fake volume distortions persist, demanding continuous improvement in detection tools. Regulatory frameworks are still maturing, raising concerns about transparency and investor protection.

Data Privacy and User Control

As platforms collect and analyze vast amounts of user data—be it cross-chain identities or behavioral signals—the importance of privacy-preserving technologies escalates. Protocols like SuiLink attempt to balance security with user control, but privacy concerns remain a critical debate.

The Sustainability of Rapid Growth

The NFT market’s rapid escalation raises questions about sustainability. Could speculative fervor lead to bubbles? How will creators, investors, and platforms manage the risks of oversupply and hype? Responsible innovation and community education are vital to avoid bust cycles.

The Road Ahead: Opportunities and Ethical Skirmishes

The Promise of Web3 Interoperability

The convergence of gaming, DeFi, and NFTs on omnichain platforms paints a promising picture of interconnected digital economies. As these projects mature, they could redefine ownership, governance, and value transfer, making Web3 more accessible and efficient.

Democratization and Community-Driven Development

Decentralized autonomous organizations (DAOs) and community-led initiatives continue to foster innovation and democratize decision-making. This promotes sustainable growth, aligning incentives across stakeholders and ensuring the ecosystem’s resilience.

Addressing the Ethical Dilemmas

As technological tools become more powerful—such as AI-driven valuations, identity linking, and behavioral analytics—the industry faces ethical challenges related to privacy, manipulation, and fairness. Transparent policies, community standards, and regulatory oversight will be essential for maintaining trust.

—

Conclusion: Embracing Challenges Amid Opportunities

The year 2025 exemplifies a period of dramatic evolution within the blockchain ecosystem—marked by heightened analysis capabilities, technological innovation, and expanding market participation. While the landscape may still wrestle with issues of manipulation, privacy, and sustainability, the collective trajectory points towards an era where transparency, interoperability, and user empowerment are paramount.

The ongoing integration of multidimensional analytics, cross-chain ecosystems, and community-driven projects will shape a future where digital assets are not only more accessible but also more fairly valued and protected. It remains crucial for stakeholders—developers, investors, regulators, and enthusiasts alike—to foster responsible innovation, ensuring the Web3 revolution benefits the many rather than the few.

Final Reflection: A Call for Vigilance and Innovation

As blockchain technology matures, the importance of technological vigilance and community integrity cannot be overstated. This era’s true potential lies not just in the advancements themselves but in our collective ability to harness them ethically, transparently, and inclusively. The journey of 2025 is a testament to rapid innovation—an ongoing dance between opportunity and challenge. How we navigate this dance will determine whether the ecosystem thrives sustainably or buckles under the weight of its own complexity.

—

References and Further Reading

– Natdog NFT ecosystem transaction analysis

– MagicNewton platform features and analytics tools

– GravityX Market Overview and Trends

– Monad Ecosystem project analysis

– BitsCrunch UnleashNFTs Attribute Rarity Tool

– Soon’s Market Sentiment Analysis

– SuiLink cross-chain identity

– Harspider Capital’s report on ETH rally

– Rhinosmart Market Analysis

*Please note that URLs direct to respective platforms or reports and are provided to deepen your understanding of the trends and tools discussed.*