The Cryptocurrency Landscape in 2025: Trends, Predictions, and AI Integration

A Volatile yet Lucrative Market

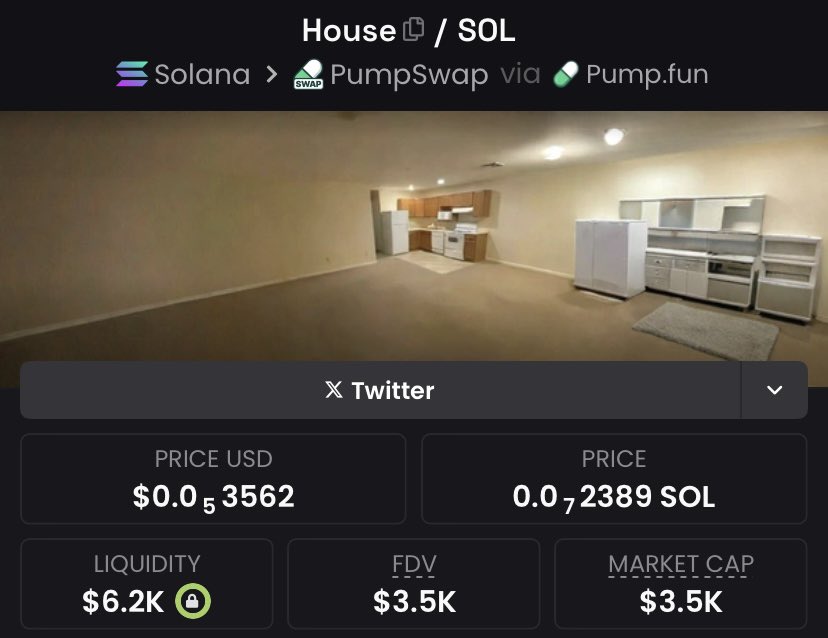

The cryptocurrency market has always been a rollercoaster, with its highs and lows often leaving investors on the edge of their seats. As of 2025, this volatility continues to define the landscape, presenting both challenges and opportunities. One striking example is the meteoric rise of a token initially highlighted at a mere $3.5K market cap, which has since exploded to a $70M valuation, marking an astonishing 2,000x return[1]. This kind of exponential growth is not uncommon in the crypto world, where fortunes can be made overnight, but it also underscores the market’s inherent risks.

The Rise of Altcoins

While Bitcoin remains the gold standard in the cryptocurrency world, altcoins are increasingly capturing the spotlight. According to recent analyses, Bitcoin’s dominance is expected to decrease, paving the way for altcoins to surge by as much as 20% to 50% this week[3]. This shift is particularly notable as major events like Token2049 in Dubai approach, drawing the attention of industry giants and investors alike. The market seems primed for a bullish season, with tariff deals and strategic emphasis on deep market analysis adding to the optimism[3].

AI and the Future of Crypto Analysis

One of the most exciting developments in the cryptocurrency space is the integration of artificial intelligence (AI) into market analysis. AI is revolutionizing how traders predict market trends and optimize investment strategies. Tools that leverage AI can analyze vast amounts of data in real-time, providing insights that would be impossible for human analysts to achieve alone. This technological advancement is not just a trend; it is becoming a necessity for anyone looking to stay competitive in the fast-paced world of crypto trading[4].

Technical Analysis: The Cornerstone of Crypto Trading

Technical analysis remains a crucial component of crypto trading. Indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are widely used to gauge market sentiment and identify potential entry and exit points. For instance, Bitcoin’s 1-hour chart analysis shows a bullish trend above the $94K support level, with RSI neutral at 55 and MACD flattening, indicating a strong uptrend with higher lows[8].

The $94,250 resistance zone, often referred to as the golden ratio in Fibonacci analysis, is another critical level to watch. Historically, this level has acted as a powerful pivot point for major market moves, making it a focal point for traders[9]. As Bitcoin approaches this resistance, the market’s reaction will be closely monitored, with potential implications for the broader cryptocurrency market.

The Importance of Community and Collaboration

The cryptocurrency community plays a pivotal role in shaping market trends and driving innovation. Platforms like Twitter serve as hubs for sharing insights, discussing strategies, and building networks. Whether it’s a seasoned trader sharing their deep market analysis or a community member expressing their enthusiasm for a particular coin, these interactions foster a collaborative environment that benefits everyone[REF]2,5,6,7[/REF].

The Role of Major Events and Influencers

Major events like Token2049 in Dubai and the actions of influential figures in the crypto world significantly impact market sentiment. For example, Changpeng Zhao (CZ), the CEO of Binance, has put emphasis on deep market analysis, which has resonated with traders and investors[3]. Similarly, the actions of exchanges like Coinbase and Kraken, such as their handling of token migrations, can influence market dynamics and investor confidence[10].

Conclusion: Navigating the Cryptocurrency Landscape

The cryptocurrency landscape in 2025 is a dynamic and exciting space, filled with opportunities and challenges. From the explosive growth of altcoins to the integration of AI in market analysis, the industry is evolving rapidly. Technical analysis remains a cornerstone of trading, with key indicators and resistance levels guiding market movements. The community’s role in fostering collaboration and innovation cannot be overstated, and major events and influencers continue to shape market trends.

As we look to the future, it is clear that staying informed and adaptable will be crucial for success in the cryptocurrency market. Whether you are a seasoned trader or a newcomer, embracing the latest tools and insights will be essential for navigating this ever-changing landscape. The journey ahead is filled with potential, and those who are prepared to seize the opportunities will undoubtedly reap the rewards.