The Cryptocurrency Landscape in 2025

Imagine a world where digital currencies are as common as fiat money. A world where Bitcoin and Ethereum are household names, and where the total market cap of cryptocurrencies is a topic of daily conversation. Welcome to 2025, where the cryptocurrency landscape is more dynamic and influential than ever before. Let’s dive into the current state of the market, the trends shaping its future, and the challenges it faces.

Market Sentiment and Institutional Adoption

Positive Sentiment Drives the Market

Market sentiment analysis in 2025 reveals a bullish outlook, with institutional adoption leading the charge. Institutional investors are increasingly viewing cryptocurrencies as a legitimate asset class, driving positive sentiment. Bitcoin, in particular, is seen as a store of value, similar to gold, and is attracting significant interest from institutional investors. This institutional adoption is a major factor in the current positive market sentiment, with a sentiment score of +0.80 for institutional adoption and +0.65 for Bitcoin[1].

Regulatory Concerns and Bearish Outlook

Despite the positive sentiment, regulatory concerns are casting a shadow over the market. The lack of clear regulatory frameworks in many jurisdictions is creating uncertainty and bearish sentiment. Regulatory concerns have a sentiment score of -0.45, indicating a significant bearish outlook. However, the smart money is moving in, suggesting that institutional investors are willing to navigate these regulatory headwinds[1].

Policy Shifts and Government Integration

Strategic Bitcoin Reserve and Regulatory Clarity

Significant policy shifts toward crypto-integration in US governance are underway. The Trump administration’s cryptocurrency policies include a strategic Bitcoin reserve and efforts to provide regulatory clarity. These policy shifts are aimed at integrating cryptocurrencies into the mainstream financial system, providing a more stable environment for investors and businesses[2].

The Role of Government in Cryptocurrency Adoption

Government integration of cryptocurrencies is a double-edged sword. On one hand, it provides legitimacy and stability to the market. On the other hand, it raises concerns about government control and surveillance. The balance between regulation and innovation will be crucial in shaping the future of the cryptocurrency market.

Technical Analysis and Market Trends

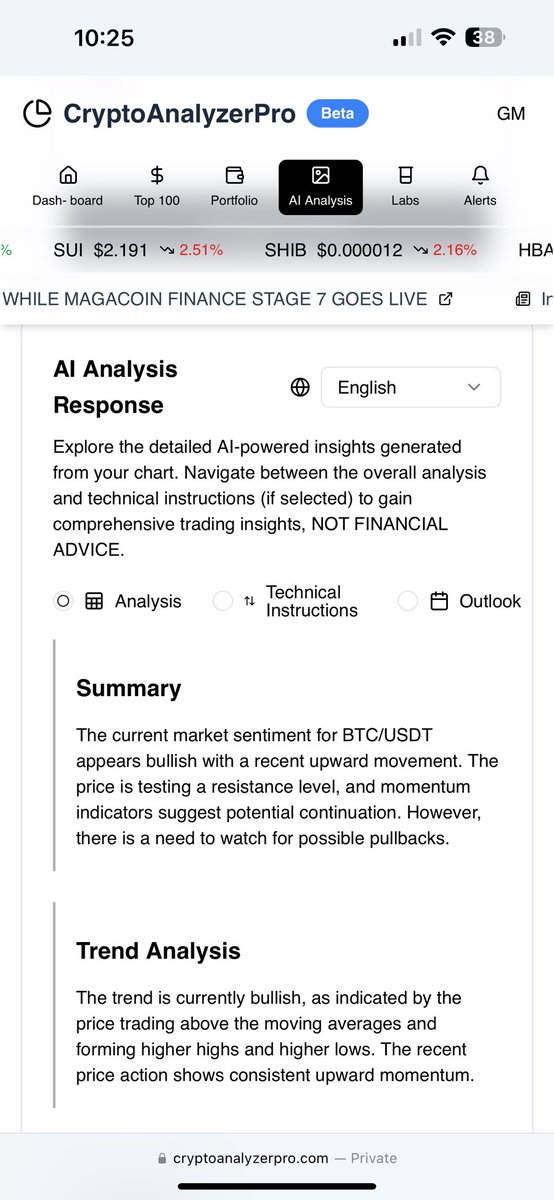

Total Market Cap Analysis

The total cryptocurrency market cap is currently consolidating within a descending channel. This consolidation is facing rejection from the resistance trendline of the channel, with the Ichimoku Cloud acting as a strong resistance barrier. This technical analysis suggests a period of consolidation before the next significant move[3].

Bitcoin and Ethereum Recovery Signals

Bitcoin and Ethereum are showing signs of recovery after recent corrections. Bitcoin is consolidating between $76K and $85K, with the Relative Strength Index (RSI) turning bullish and increasing volume. The key resistance level at $85K could trigger the next leg up. Ethereum, on the other hand, is stabilizing between $1,450 and $1,650, with the RSI bouncing from oversold territory. The key level to watch for Ethereum is $1,700[4,5].

Challenges and Risks

Rug-Pull Patterns and Market Manipulation

The cryptocurrency market is not without its risks. Analysis reveals potential rug-pull patterns in some crypto projects, where insiders dump holdings at the expense of Initial Coin Offering (ICO) participants. These rug-pull patterns highlight the need for vigilance and due diligence in the cryptocurrency market[6].

Impulsive Moves and Market Volatility

Impulsive moves in cryptocurrency futures trading refer to sudden and significant price movements driven by market sentiment, news, or other factors. These impulsive moves can lead to high volatility and market manipulation, making it challenging for investors to navigate the market[7].

The Future of Cryptocurrency

AI and Decentralized Networks

The future of cryptocurrency lies in the integration of artificial intelligence and decentralized networks. Projects like AlloraNetwork are taking AI to the next level by connecting AI models to provide accurate and fast predictions for decentralized finance (DeFi), cryptocurrency prices, and complex data analysis. These advancements will enhance the efficiency and accuracy of the cryptocurrency market, making it more accessible and reliable for investors[8].

The Role of Innovation and Regulation

Innovation and regulation will play a crucial role in shaping the future of the cryptocurrency market. While innovation drives the market forward, regulation provides the necessary stability and security. The balance between the two will determine the success and sustainability of the cryptocurrency market.

Conclusion

Embracing the Future

The cryptocurrency landscape in 2025 is a testament to the power of innovation and the resilience of the market. Despite the challenges and risks, the market continues to evolve and grow, driven by positive sentiment, institutional adoption, and technological advancements. As we embrace the future, it is essential to stay informed, vigilant, and adaptable. The cryptocurrency market is not just a financial revolution; it is a societal shift towards a more decentralized and inclusive financial system. The future is here, and it is digital.

References

[1] Cryptocurrency Market Sentiment

[2] Policy Shifts and Government Integration

[3] Total Market Cap Analysis

[4] Bitcoin Recovery Signals

[5] Ethereum Recovery Signals

[6] Rug-Pull Patterns

[7] Impulsive Moves

[8] AI and Decentralized Networks