Monthly Jobs Report and White House Crypto Event: A Dual Focus on Economic Growth and Digital Innovation

Introduction: Economic Indicators and Digital Frontiers

As the U.S. economy continues to navigate through challenging times, two significant events are set to capture the nation’s attention: the release of the monthly jobs report and a White House event focused on cryptocurrency. The jobs report, released on March 7, provides crucial insights into the health of the labor market, while the crypto event highlights the administration’s interest in digital assets. Let’s delve into these developments and explore their implications for the economy and technological innovation.

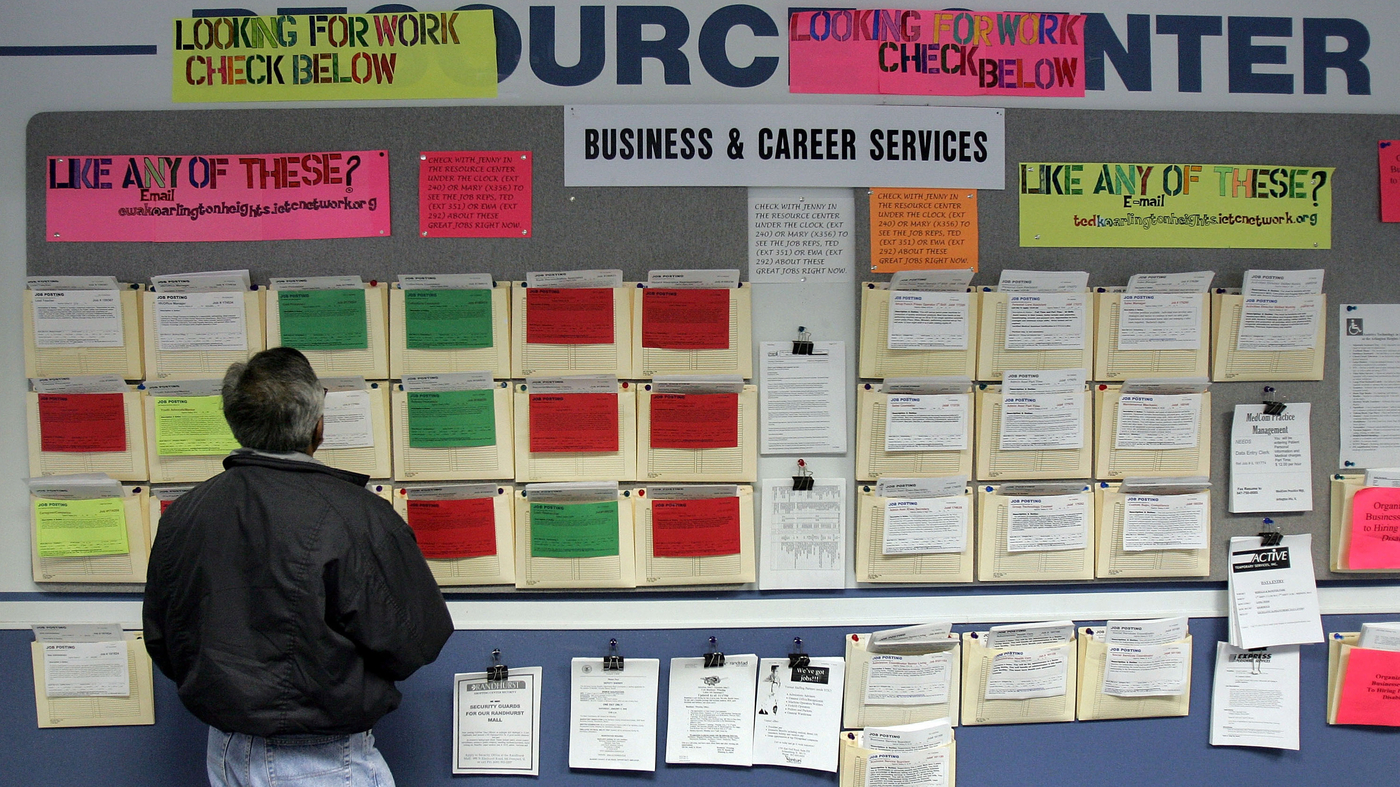

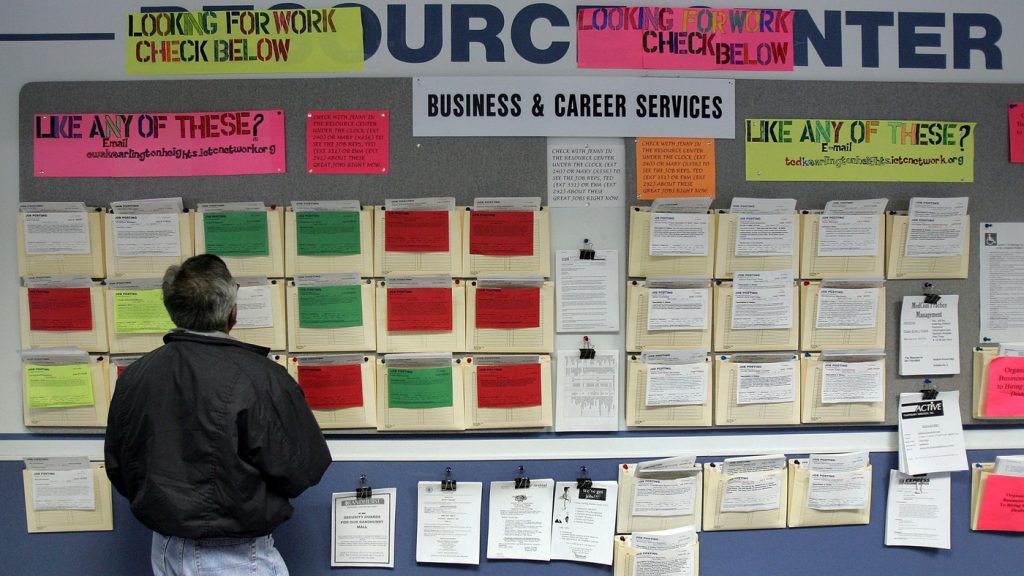

The Monthly Jobs Report: A Snapshot of Economic Performance

The latest jobs report revealed that employers hired 151,000 workers in February, falling short of expectations of 170,000 jobs added[1]. This figure marks a slight decrease from the average monthly job gains seen last year. The unemployment rate ticked up to 4.1%, maintaining a historically low level despite the slight increase[1]. These numbers suggest a mixed picture for the U.S. economy, with some sectors experiencing growth while others face challenges.

– Key Industries and Trends: Health care and leisure and hospitality have been among the sectors showing consistent job growth. However, retail trade has experienced declines, reflecting broader consumer spending trends[3].

The White House Crypto Event: Exploring Digital Assets

The White House is set to host an event focused on cryptocurrency, signaling a growing interest in digital assets. This move aligns with broader discussions about the role of cryptocurrencies like Bitcoin in the financial system. At the Conservative Political Action Conference (CPAC), there was a strong emphasis on Bitcoin as a form of digital property and its potential for economic growth[4].

– Bitcoin and Economic Strategy: Proponents argue that investing in Bitcoin could strengthen the U.S. dollar and provide significant economic benefits, potentially even neutralizing national debt[4]. However, such strategies are speculative and require careful consideration of regulatory and market risks.

Economic Challenges and Opportunities

The U.S. economy is facing several challenges, including rising inflation and consumer price increases. Consumer prices rose 3% in January compared to the previous year, exceeding the Federal Reserve’s target of 2%[1]. Additionally, tariffs imposed by the Trump administration have led to increased costs for consumers and uncertainty in trade relations[2].

– Inflation and Consumer Confidence: Despite these challenges, some consumer sentiment indicators have shown improvement, such as assessments of current business conditions and home purchasing plans[1]. However, the overall outlook remains cautious, with many consumers expecting economic conditions to worsen.

Conclusion: Balancing Economic Growth and Digital Innovation

In conclusion, the monthly jobs report and the White House crypto event highlight two critical aspects of the U.S. economy: traditional labor market performance and emerging digital opportunities. As policymakers navigate these areas, they must balance economic growth with innovative strategies that address both current challenges and future possibilities.

—

Sources:

– ABC News

– GovInfo

– BLS

– Happy Scribe

– Morning Star