Introduction: Revolutionizing Payments with BVNK’s Embedded Wallet

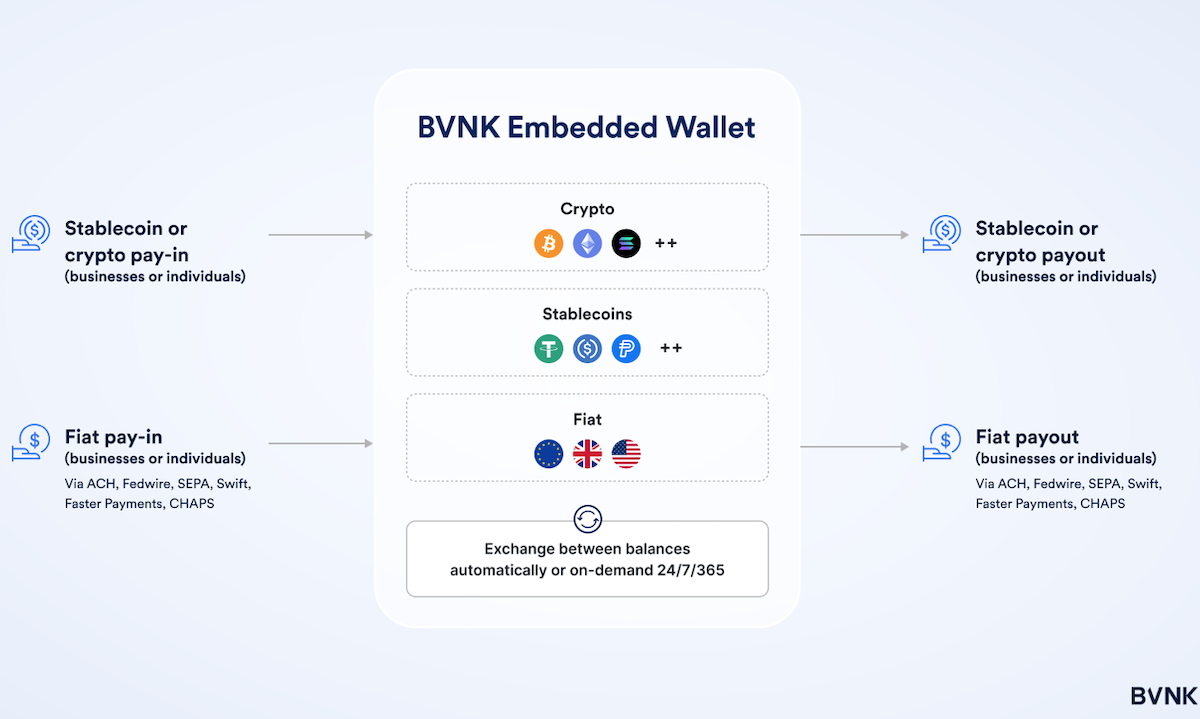

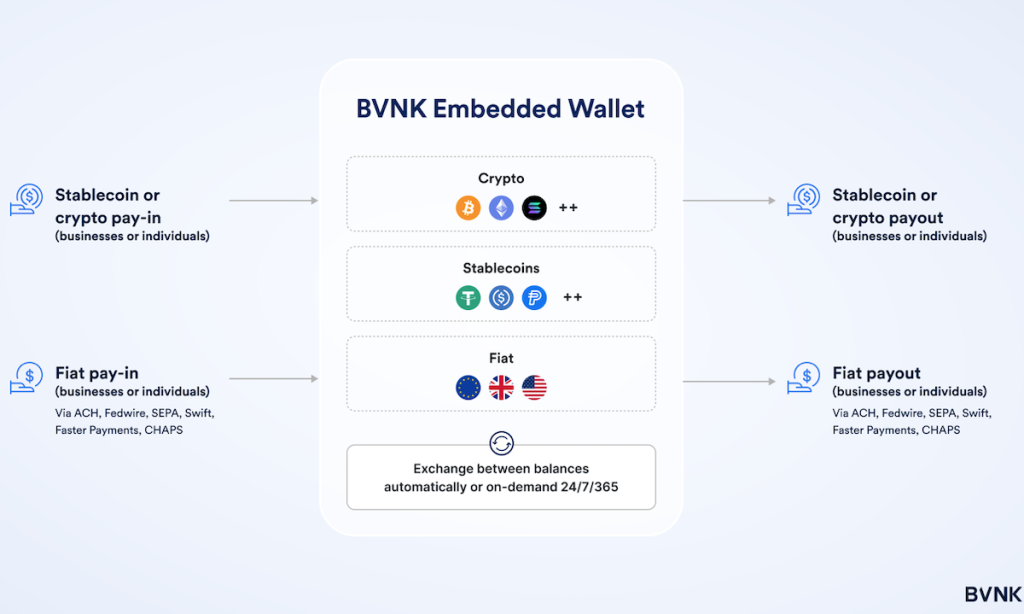

In a significant move to simplify and enhance the global payment landscape, BVNK has unveiled an innovative embedded wallet designed to seamlessly integrate stablecoin, cryptocurrency, and fiat payments. This cutting-edge solution aims to provide users with unparalleled flexibility and accessibility across various payment networks. Let’s dive into the details of this groundbreaking development and explore how it’s poised to transform the way we make transactions.

The Embedded Wallet: A Game-Changer in Payments

BVNK’s embedded wallet is a first-of-its-kind solution that integrates multiple payment rails into a single platform. This means users can store, spend, and receive payments in stablecoins, cryptocurrencies, and traditional fiat currencies like USD, GBP, and EUR[4]. The wallet supports connections to major blockchains such as Ethereum, BNB Smart Chain, Bitcoin, and Cardano, as well as traditional payment networks like SWIFT, ACH, and SEPA[4].

Key Features and Benefits

– Interoperability: The wallet allows for seamless transactions between different currencies and blockchains, making it easier for businesses and individuals to manage their finances across borders[4].

– Cost-Effectiveness: Stablecoins, in particular, offer a cost-effective solution for cross-border transactions, reducing fees significantly compared to traditional methods[2].

– Accessibility: By supporting both fiat and digital currencies, BVNK’s wallet enhances financial inclusion, especially in regions where access to traditional banking services is limited[4].

Stablecoins: The Backbone of Efficient Payments

Stablecoins have emerged as a crucial component in modern payment systems due to their stability and efficiency. They are pegged to traditional currencies, which helps mitigate volatility and makes them ideal for everyday transactions[4]. Stablecoins have already started to disrupt traditional banking by offering faster, cheaper, and more secure transactions[2].

Impact on Traditional Banking

The rise of stablecoins and wallets like BVNK’s poses a significant challenge to traditional banking systems. By reducing the need for intermediaries, stablecoins can lower transaction costs and increase the speed of payments, potentially decreasing bank deposits and lending activities[2].

Future Prospects and Challenges

As the adoption of stablecoins and integrated wallets grows, we can expect to see further innovations in the financial sector. However, challenges such as regulatory clarity and security remain crucial for widespread acceptance[4].

Regulatory Environment

The regulatory landscape for cryptocurrencies and stablecoins is evolving rapidly. Clear guidelines will be essential for ensuring the stability and security of these financial instruments[3].

Conclusion: A New Era in Payments

BVNK’s embedded wallet represents a significant step forward in the evolution of payment systems. By bridging the gap between traditional and digital currencies, it offers users unprecedented flexibility and efficiency. As the financial world continues to embrace digital assets, solutions like BVNK’s will play a pivotal role in shaping the future of money.

—

Sources:

– paymentexpert.com

– rolandberger.com

– github.io

– thisweekinchia.com