“`html

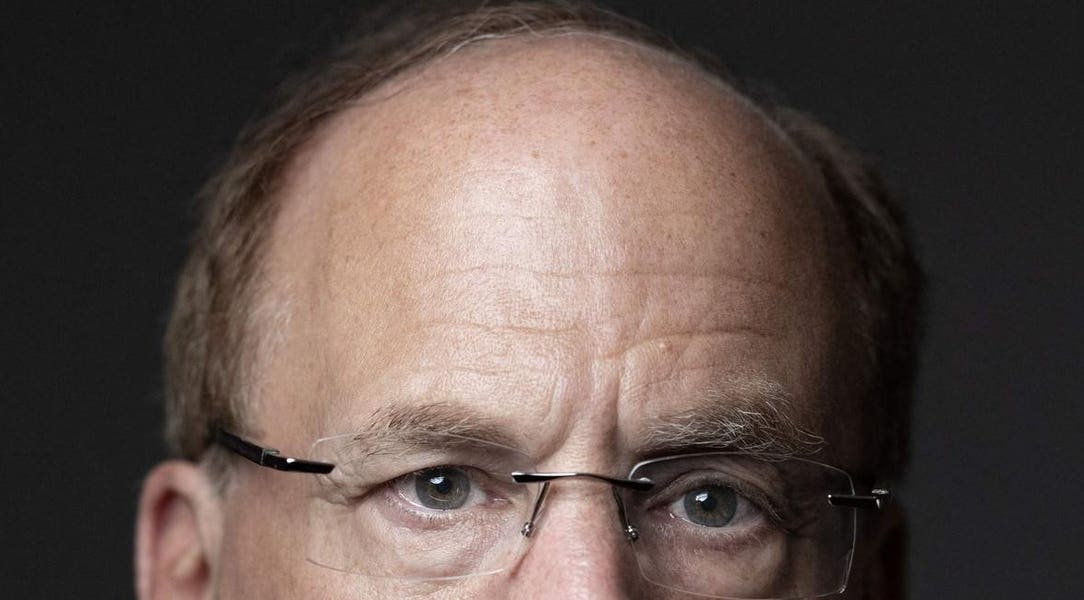

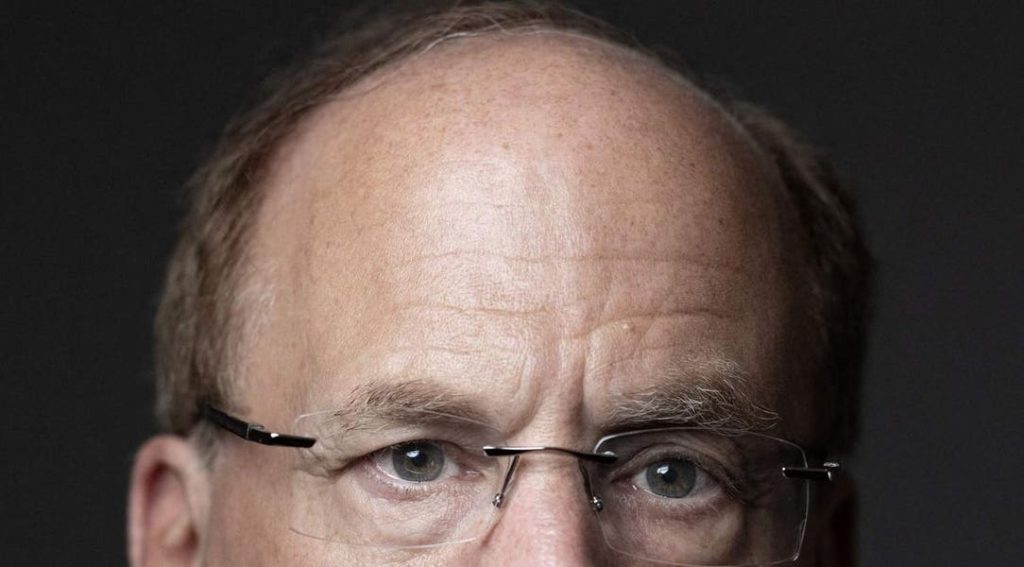

Analysis: BlackRock’s $150 Billion Model Portfolio Includes Bitcoin

In a world where even the mightiest giants tread cautiously, BlackRock, towering with over $11 trillion in assets under its watchful eye, has dared to dance with the volatile world of Bitcoin. With a mere whisper of $150 billion, BlackRock has welcomed Bitcoin into its meticulously crafted universe of model portfolios.

Background

BlackRock, a mastermind in creating investment strategies for financial advisors, has unfolded a new chapter by introducing Bitcoin into its carefully constructed portfolios. This move opens a gateway for investors to dip their toes into the realm of cryptocurrencies. The allocation of Bitcoin, though small, is set to grace the portfolios, sprinkling around 1% to 2% of the total mix.

The iShares Bitcoin Trust (IBIT) ETF

BlackRock has chosen the iShares Bitcoin Trust (IBIT) ETF as its chariot to carry Bitcoin into the model portfolios. Standing tall with around $48 billion in assets, the IBIT ETF has drawn attention, clutching about 2.9% of the Bitcoin universe. Despite recent fluctuations in Bitcoin ETFs, the IBIT inclusion by BlackRock could spark enthusiasm and allure institutional investors closer.

Strategic Significance

This move by BlackRock paints a picture of strategic brilliance:

- Institutional Adoption: With Bitcoin nestled in its portfolios, BlackRock signals for a broader embrace of cryptocurrencies among the elite institutions. This stamp of approval may set the stage for increased demand, possibly lifting Bitcoin to new heights.

- Diversification: BlackRock flaunts Bitcoin as a dazzling gem in its treasure trove of investments. The rarity, value-holding capacity, and potential to shield against monetary turbulence make Bitcoin a sought-after diversifier in the traditional investment expanse.

- Market Sentiment: Amid a backdrop of economic uncertainties and regulatory shadows, BlackRock’s move bursts forth as a ray of hope. This nod of confidence could change the tune around cryptocurrencies and prompt other financial giants to follow suit.

Impact on Bitcoin Price

The immediate impact of BlackRock’s decision on Bitcoin’s value may seem trivial due to the humble portion allocated. But do not be fooled; the symbolism ingrained in this shift is potent. BlackRock’s embrace signals a belief in Bitcoin’s enduring value, potentially drawing more institutional investments over time.

Challenges and Future Prospects

For all its promise, challenges still lurk on Bitcoin’s path. Volatility remains a shadow, casting doubt on larger allocations that may rock the boat of portfolio stability. The recent outflows from Bitcoin ETFs whisper tales of caution from investors, a tune that may echo in the future.

Yet, BlackRock’s bold move could galvanize the giants of the asset management world to reconsider their cryptocurrency stance. A successful domino effect could normalize Bitcoin’s presence in institutional realms, solidifying its standing as an alternative asset class.

Conclusion

BlackRock’s inclusion of Bitcoin in its model portfolios stands as a monumental milestone with far-reaching implications for the cryptocurrency arena. While the immediate financial ripples may be subdued, the strategic and emblematic weight of this decision is colossal. It heralds Bitcoin’s ascent as a validated investment avenue, potentially leading the charge towards broader institutional acknowledgment in times to come.

“`

Related sources:

[1] www.binance.com

[2] cryptoslate.com

[5] www.coindesk.com